🍔New Trade Entered

The Death of Software is here

Welcome back to MktContext where we explain what’s happening in the US economy, and use that to time the stock market.

Weeks ago we warned that equity positioning is overstretched and there is risk to the downside. “When everyone has already bought, there is no one left to buy.” We urged caution as we knew there could be large overreactions to negative news.

Last week we said markets are “highly fragile” and that’s exactly what we got. Markets have done a huge round-trip, a big selloff and huge intraday swings both up and down. As predicted, negative gamma effects exacerbated moves in both directions since dealers must buy into strength and sell into weakness.

SPX is closing just shy of its record high, but Nasdaq has taken a deeper hit. Has the positioning cleared? Or will we get more downside?

The index movements further mask a wide dispersion at the individual stock level, especially in software stocks which are undergoing their own recession. This week’s note discusses the software crash, and whether now is the time to be buying software stocks.

Today’s topics: Death of software, macro getting better, 2026 outlook, positioning marks a bottom, new trade alert, our portfolio and SPX breakout.

Death of software

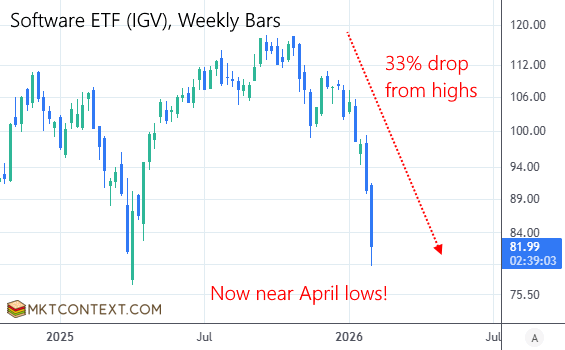

This week we saw a sharp unwind in software stocks that dragged the Nasdaq down (dubbed “SaaS-pocalypse”). We initiated on this topic several weeks ago arguing that software is getting democratized and the SaaS pay-per-user business model is under pressure. The market is now waking to this reality, sending the IGV ETF down -33% to April lows:

The latest catalyst appears to be Anthropic’s release of new plugins for Claude Cowork (an autonomous AI agent). These plugins are able to perform the functions of entire departments including Legal, Sales & Marketing, Finance & Accounting, Data Analysis, and Productivity & Search.

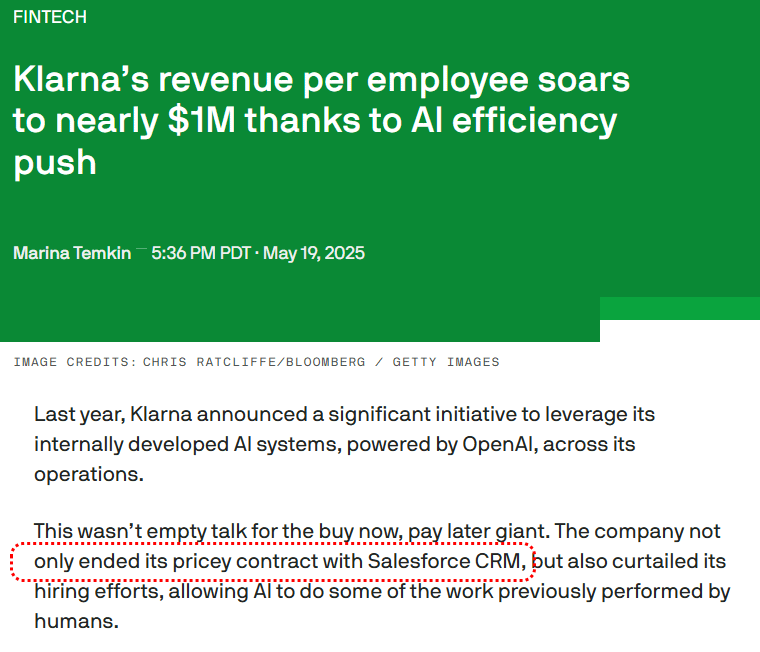

The major concern is that AI agents can take over what software accomplishes today. When one agent can automate what ten humans used to do, that’s ten subscription revenues that the software vendor loses. The data is already showing per-user pricing dropping off.

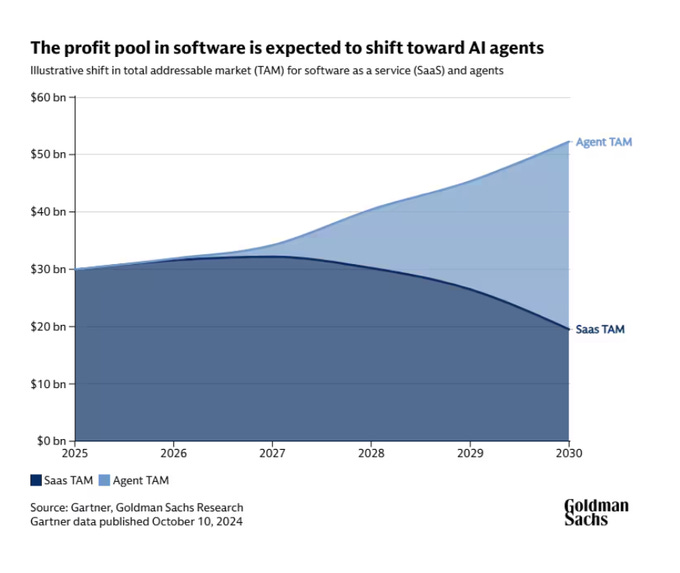

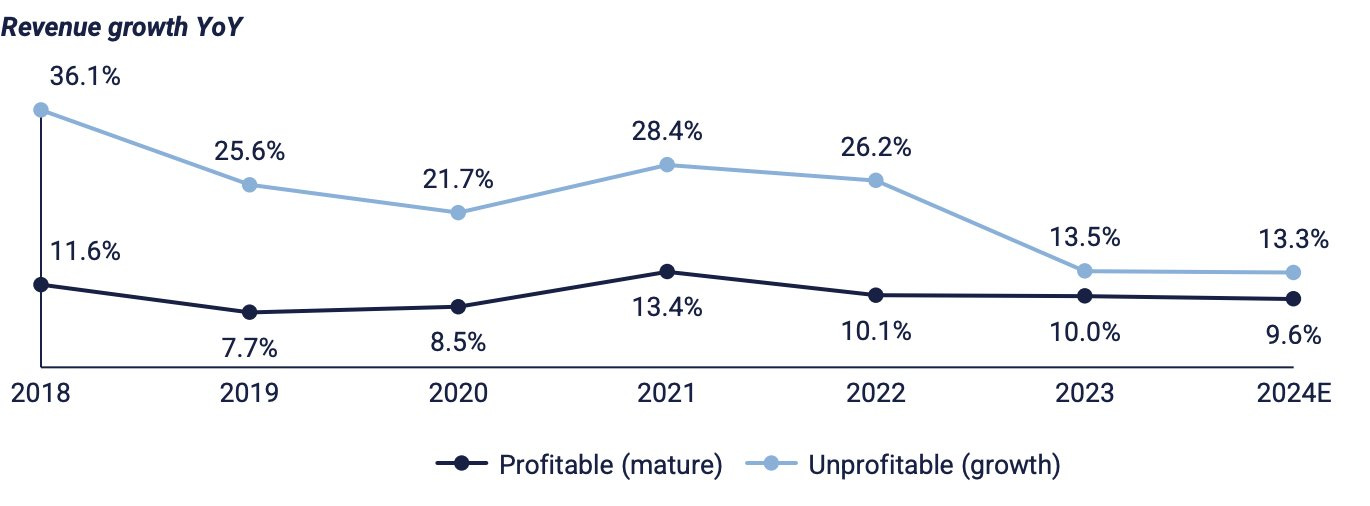

It is estimated that in the long run, AI agents will steal 60% of profit from software companies:

The productivity gains from AI agents are staggering. Companies are reporting 3-4x productivity gains and 2x revenues-per-employee. Software vendors are forced to switch from the old per-user model to a fixed pricing model with AI-assisted workflows, or face obsolescence. The very AI features vendors are building to retain customers are giving those customers the tool to shrink their contracts.

It is tempting to argue against this regime change with reasons like “AI generated software can’t be trusted” or “software is deeply embedded in workflows and can’t be replaced”. That misses the point entirely.

Software vendors have gouged customers for decades and customers are now looking at this area for obvious cost cuts. Instead of paying for an extra seat, they can eliminate that need altogether. In this way, software companies have lost their pricing power due to disruption, even if they don’t lose demand any time soon.

Contagion risk

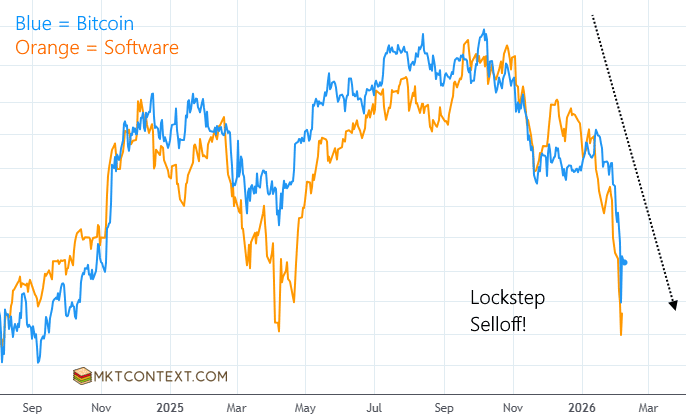

The software selloff is infecting Bitcoin. Both assets have sold off in lockstep since August. There are no coincidences in financial markets, and it is likely that venture capital investors are overleveraged in both assets, leading to margin calls and cross-liquidations.

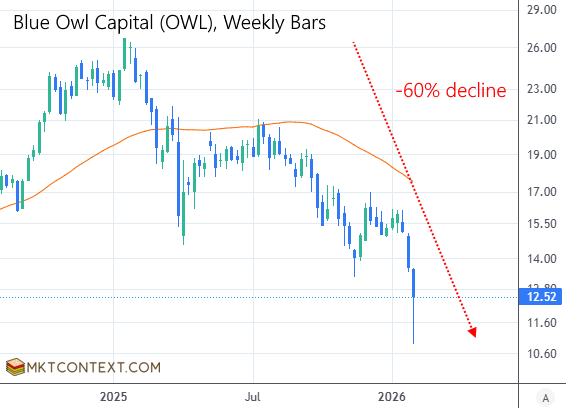

On top of that, software concerns are infecting the private equity and private credit markets. For years, lenders like Blue Owl and Ares earned attractive returns financing software startups with predictable subscription revenues. These investors are now forced to revalue their books as growth slows drastically and a wall of debt is set to mature:

To see our trades and portfolio, consider upgrading to paid subscriber status.

Where’s the bottom?

So where do software stocks bottom? Surely, not every company will vibe-code their own software for the hundreds of products they use. And those that do can’t also replicate the required maintenance, design iteration, and database management.

What will happen is that “low effort” software will be replaced. SaaS products that were really just a database and a login screen can no longer command premium pricing. Software companies need a real moat to survive (think deep integration across enterprise workflows) or leadership that is willing to evolve with the times.

For now, the broader software landscape remains in a recession. Slowing jobs growth and AI efficiencies are still pressuring per-user revenues. To make matters worse, IT budgets are getting reallocated away from software spending towards new AI projects.

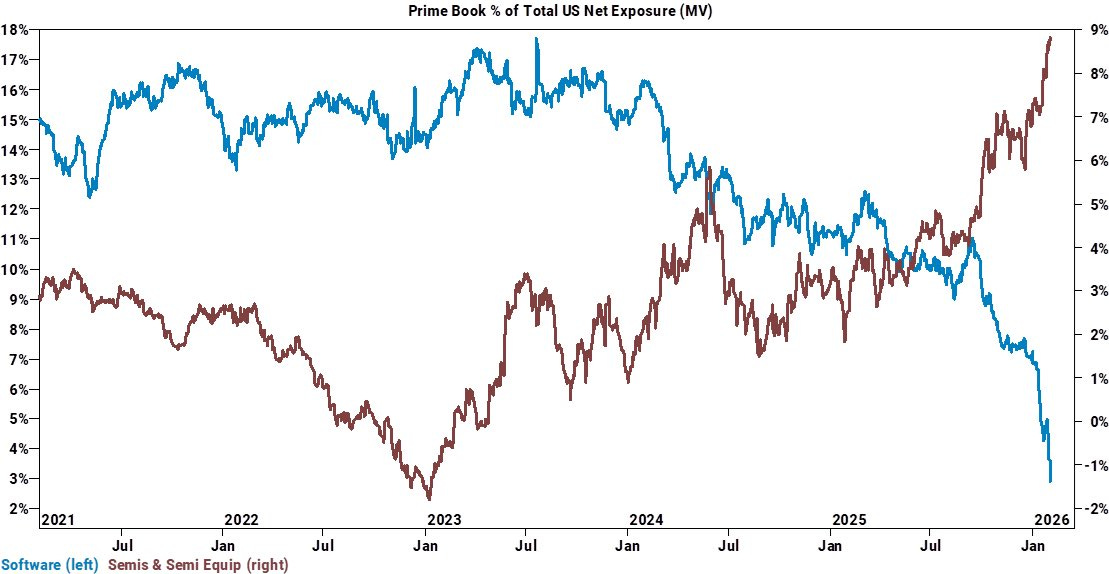

That said, the selloff is starting look overdone. The IGV ETF is near April Liberation Day lows, with valuation levels at extreme lows (particularly relative to chip stocks). Below shows hedge fund positioning in chip stocks (brown line) versus software stocks (blue line) is at a generational wide spread. When momentum is at extremes, it is liable to mean-revert.

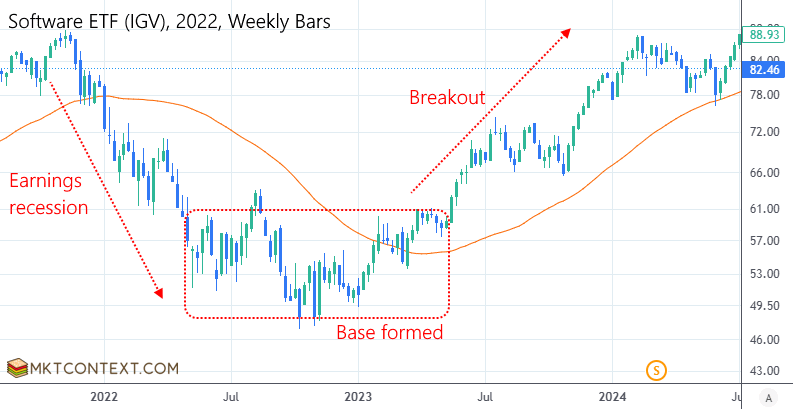

So a trade is setting up to long software stocks outright, or against a short in chip stocks. For us to be interested, we want to see IGV form a base over the next few weeks (if not months). For example, in the 2022 tech recession (chart below), IGV formed a year-long base before finally breaking out. Structural concerns do not go away overnight. Wait for the consolidation to occur before stepping in.

The rest of this article is for premium members. Upgrade now to continue reading:

Macro getting better

Positioning marks a bottom

Technicals are bullish but shaky

New trade alert

Our portfolio and impending breakout

Claim your free trial by clicking the button below!

Keep reading with a 7-day free trial

Subscribe to MKTCONTEXT to keep reading this post and get 7 days of free access to the full post archives.