🍔2 Crises This Week

Greenland invasion and tariffs; Japan bond market crash

Welcome back to MktContext where we explain what’s happening in the US economy, and use that to time the stock market.

Markets experienced a sudden shock this week as two major crises unfolded: Trump threatening to invade Greenland and tariff Europe, and a bond market crash in Japan similar to the UK’s 2022 Liz Truss moment.

These events leave lasting footprints in the price charts that give us clues to market-wide positioning. It tells us what might happen next. Even though SPX is back near its highs, the danger is not automatically cleared as positioning remains very high.

Could this be the final moment before the February selloff?

Today’s topics: Greenland invasion, Japanese bonds, interest rates, equity positioning, sector analysis, cyclical recovery, Mag 7, and our positioning.

Greenland Invasion

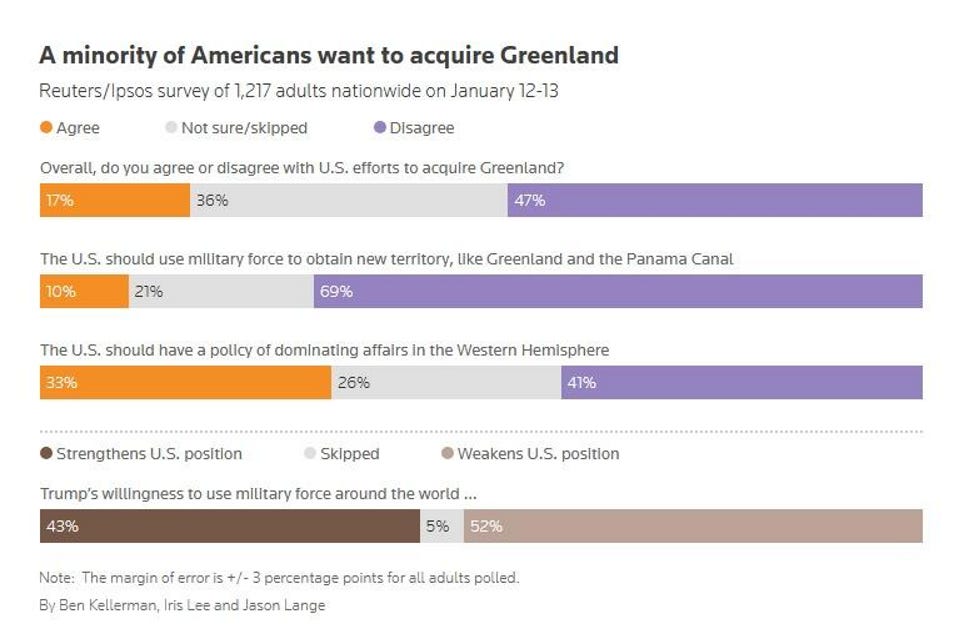

Last week, Trump threatened 25% tariffs on European countries if they didn’t let US take over Greenland. He framed it as vital for national security against Chinese and Russian arctic ambitions, reviving a long-standing US interest in the territory.

Markets have grown accustomed to Trump’s false tariff threats. By midweek, he had retracted. After talks with NATO Secretary General Mark Rutte, they had purportedly arrived at a “deal” for Greenland.

So why does Trump want Greenland? Greenland observes a naval choke point in the North Atlantic (between Greenland, Iceland, and UK). This is the gateway for Russian submarines to enter the Atlantic Ocean via the Arctic, and threaten US shipping lanes and the US East Coast.

As the Arctic ice cap melts, new shipping lanes are opening up. Soon, Russia and China will use these routes to expand their trade and naval influence. China can also bypass the choke point by building infrastructure in Greenland (they have already attempted to bid on airports and ports on the island).

Say what you will about Trump, but he is not crazy and this isn’t about ego. He is simply acting on Pentagon national security intel.

The second reason for invading Greenland is for resources. Greenland houses vast rare earth metal deposits which also come with uranium oxide as a byproduct. Uranium oxide can be sold to nuclear reactors, thus subsidizing the processing of rare earth metals. This allows the West to have cost competitive rare earth processing facilities.

As we’ve written about before, the US wants to immunize its high-tech supply chain from foreigners. That includes reducing dependance on China for rare earth processing.

So what does the negotiated deal entail? At this point we think it will be some sort of land lease (allowing the US control without ownership). The US will be allowed to expand its military bases, on-ground presence, and defense architecture. They will likely be granted mineral rights as well.

For Denmark and NATO’s part, they will be asked to increase defense spending for this important choke point. Right now European members spend on average 2% of GDP on defense, whereas Trump would want 4-5% as seen in the US. This will be a small cost in lieu of conceding its land.

While there appears to be an uneasy truce and negotiations are ongoing, we don’t think it’s settled just yet. Trump has a long agenda for a midterm election year and it’s unclear how much Denmark will want to budge. The market is overpricing the latest TACO move (Trump Always Chickens Out) and underpricing the risk of further escalations. Watch for this issue to rear its ugly head again in the coming weeks.

To see our trades and portfolio, consider upgrading to paid subscriber status.

Japanese bond market

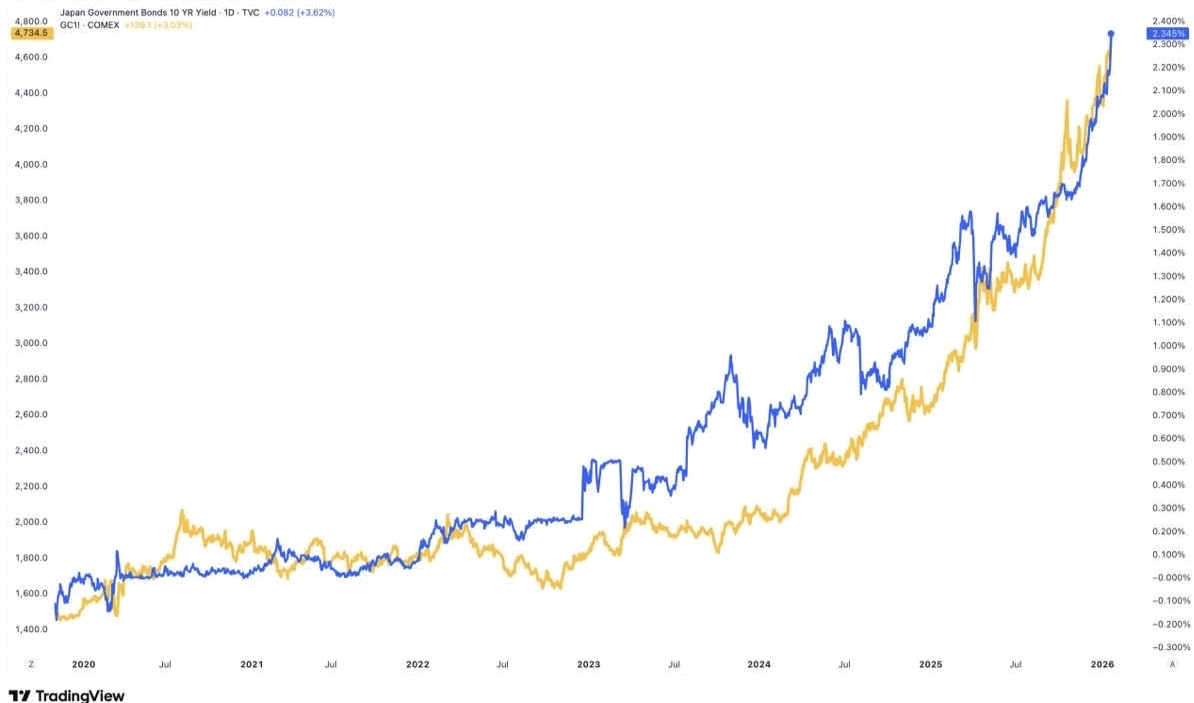

The second crisis was the sharp selloff in Japanese bonds and long-term interest rates surging to record highs. Prime Minister Takaichi floated an ambitious fiscal plan of cutting taxes on food, but without money to fund it. Bond investors viewed this budget to be unsustainable, similar to the UK’s Liz Truss budget in 2022 that caused a meltdown.

When a nation’s fiscal position deteriorates, meaning it risks rising debt levels or defaulting on its obligations, the bond market punishes them with higher yields. That is the balancing factor that stops all governments from spending profligately.

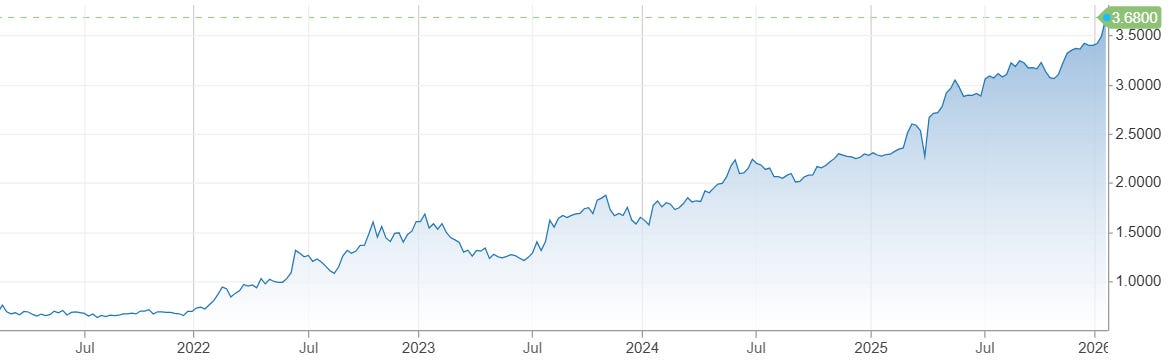

The result: Long-term Japanese yields exploded to record highs. The effect started spilling over into US Treasury bond markets, which also experienced a sharp rise in rates. This represents a tightening of financial liquidity conditions, causing Tuesday’s selloff in stocks.

Ultimately, the Central Bank of Japan coordinated efforts to calm bond markets. Japan’s pension funds and life insurance companies banded together to support the bond market. When the Central Bank of Japan wants to intervene in financial markets, they often recruit the help of the nation’s institutions to do so.

As it relates to SPX, these kinds of dislocations are often short-lasting. It forces an unwind of elevated positioning but without long-term damage. Recall the Yen carry trade debacle in Aug 2024 that caused only a brief selloff. We think the issue is well contained and SPX should recover from here.

On the other hand, the selloff in Japanese bonds has been a key driver of the gold and silver rally. The chart below shows Japanese interest rates (blue) and gold prices (yellow). When two sleepy assets suddenly go parabolic in tandem, it’s not a coincidence. In response to Japan’s fiscal deterioration, investors have been selling the country’s bonds and moving into gold for protection:

Interest rates moving…

The rest of this article is for premium members. Upgrade now to continue reading:

Interest rates are impacting financial liquidity

Equity positioning has risen sharply

Cyclical recovery

Mag 7 recovering

Our portfolio

Claim your free trial by clicking the button below!

Keep reading with a 7-day free trial

Subscribe to MKTCONTEXT to keep reading this post and get 7 days of free access to the full post archives.