🍔Gold and Silver Melting

Plus: Deep dive into Kevin Warsh, the next Fed Chair...

Welcome back to MktContext where we explain what’s happening in the US economy, and time the stock market.

Topic of the week is the historic meltdown in precious metals, particularly gold and silver.

We also had a very intense week of price reactions as SPX and Nasdaq whipped around without making real progress. Let’s talk about what happened.

From Jan 21 to 28, the Mag 7 rallied sharply with multiple gap-up days, on the expectation of strong earnings reports. We previously noted that positioning had risen sharply which gave us pause. The view on the Street was Mag 7’s earnings results would catalyze a breakout of the consolidation range.

As we wrote last week, “When everyone has already bought, there is no one left to buy.”

Mag 7 earnings results were indeed strong but Nasdaq sold off on the week. This creates a “good news bad price” setup where good news fails to drive stocks higher. It is a key indication that everyone has already bought, leaving no buyers for the news.

With multiple failed attempts at the break of all-time highs, we need to reassess the outlook for SPX and QQQ. Will we get a continuation of the rally? Or are we setting up for a deeper bear market similar to 2022 and 2025?

Today’s topics: Gold/silver crash, FOMC, Kevin Warsh, tech earnings, macroeconomy, technicals, our portfolio.

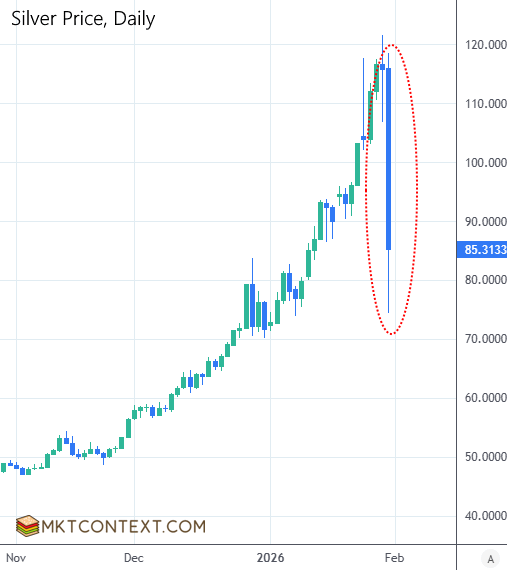

Gold and silver crash

This week, gold and silver finally collapsed under the weight of their parabolic rise. what started as a wobble on Thursday turned into a full-blown implosion on Friday. The move was triggered by a series of margin hikes on speculators, a trading halt in Shanghai, and a leveraged ETF liquidation.

This toxic cocktail triggered a massive downside grab for liquidity, but there were no buyers. Only a giant air pocket underneath. The result: a -14% drop in gold and -37% drop in silver within one day.

This parabolic rise and collapse is a good pattern to recognize as the same can happen to individual stocks. Coincidentally, here is SNDK on the same day after reporting blowout earnings and gapping over 20%, then waterfalling back down. SNDK is up 136% in January alone and 1500% over the past twelve months. (It is not a penny stock; it’s a mega cap tech company!) Learn to recognize when these types of moves are happening and signs of exhaustion.

To see our trades and portfolio, consider upgrading to paid subscriber status.

FOMC

The Fed meeting went as expected. They remained on hold, with 2 dissenters (Miran and Waller) who wanted a 25 bps cut.

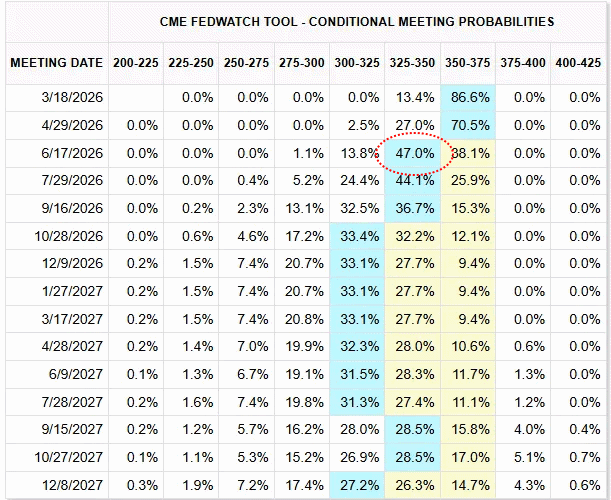

Key to their decision was the labor market showing signs of stabilization, while inflation risk is lower. The whole point of cutting rates in the past several meetings was to support jobs, but that may not be necessary anymore. Hence, rate cut odds fell:

Fed members see some uncertainty in the economy, but things are generally on the up and up; consumer spending resilient, fixed investment expanding, shutdown distortions dissipating. We’ve been talking about the reacceleration thesis for a while now, so it’s nice to have the Fed confirm.

Powell declined to comment on the DOJ subpoenas or whether he will stay on the board after his term as Chair ends. Market continues to discount Fed messaging, on the assumption that the next Fed Chair will push several cuts in 2026.

The risk with this thinking is that the new Chair fails to convince the others to cut (it is a vote, after all) and inflation concerns take a higher turn. The market won’t get the cuts it’s hoping for, which will be bad for stocks. On that note, let’s talk about the next Fed Chair.

Who is Kevin Warsh?

Trump announced the next Fed Chair to be Kevin Warsh. The debate is focused on whether he will cut rates or not, but that misses a huge point about Warsh’s ideologies…

The rest of this article is for premium members. Upgrade now to continue reading:

Kevin Warsh and the impending Fed regime change

Tech earnings

Fundamentals strong, technicals shaky

Our portfolio and the coming consolidation break

Claim your free trial by clicking the button below!

Keep reading with a 7-day free trial

Subscribe to MKTCONTEXT to keep reading this post and get 7 days of free access to the full post archives.