🍔Software Companies are In Trouble

Small cap stocks successful break out, SPX and tech fail

Welcome back to MktContext where we explain what’s happening in the US economy, and use that to time the stock market.

The S&P500 and Nasdaq failed to break out of their consolidation patterns so far. Meanwhile, the rest of the market, particularly small caps, cyclicals, and cryptocurrencies successfully broke out on the back of rising liquidity factors.

In other words, dispersion amongst stocks is rising. In today’s letter, we discuss the positives and negatives in this stock market.

Today’s topics: Bank earnings, credit card cap, Claude Cowork, software democratized, Netflix, liquidity, positioning.

Bank earnings

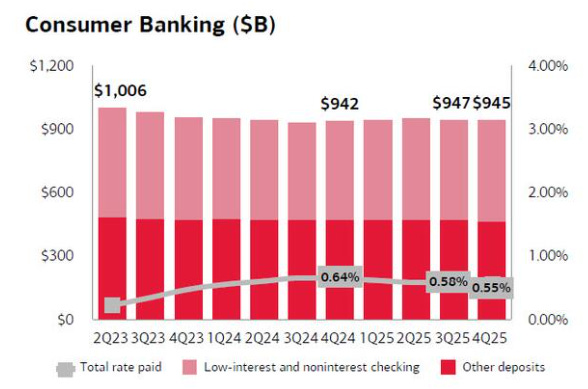

Several major banks reported this week (JP Morgan, Citigroup, Wells Fargo, Bank of America). We follow banks closely as they are a barometer of economic health. The banks are saying the economy is slowing but not falling apart. They still see growth, but it’s not booming like in 2021-2022.

“Account balances for the US consumer were stable through the year. Delinquencies and charge-offs improved in 2025.”

“Consumer spending grew 5% over 2024 levels.”

-Bank of America CEO Brian Moynihan

“If you asked me in the short run, call it six months and nine months and even a year, it’s pretty positive. Consumers have money.”

-JP Morgan CEO Jamie Dimon

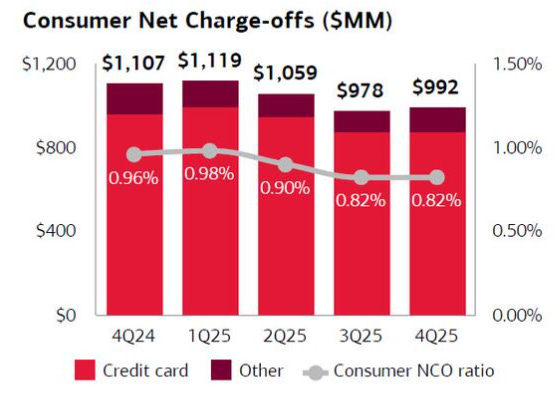

The consumer is holding up. People are still spending because they remain employed and checking account balances are stable. However, pandemic-era “excess savings” are spent, so people are selective with their spending. Credit card charge-offs are rising from very low levels but not at crisis levels yet.

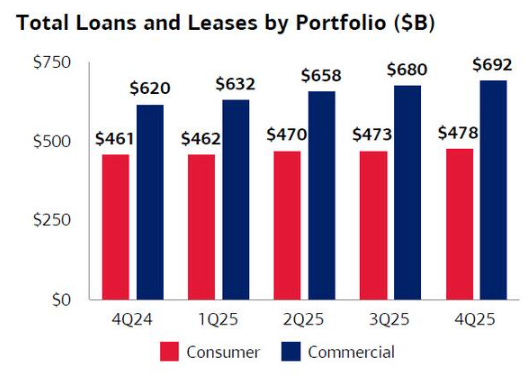

The banks are seeing loan growth, but it’s uneven. For example commercial and industrial lending is growing faster than consumer loans. That jibes with our view that the economy is reaccelerating even as the job market slows down.

Higher interest rates from prior years are still weighing on mortgage activity and the housing markets. So banks are not seeing a boom in new home lending. However, ongoing demand is still inching up, even if volumes are not strong. It will likely take some time for our housing thesis to play out.

The overall message is clear: slow but steady growth, not a boom, not a recession. Consumers are still spending and paying debts, but with less of a savings cushion, so any big shock (job losses or jump in rates) would hurt more. Businesses are cautious about borrowing, which fits a “wait and see” mood on the economy.

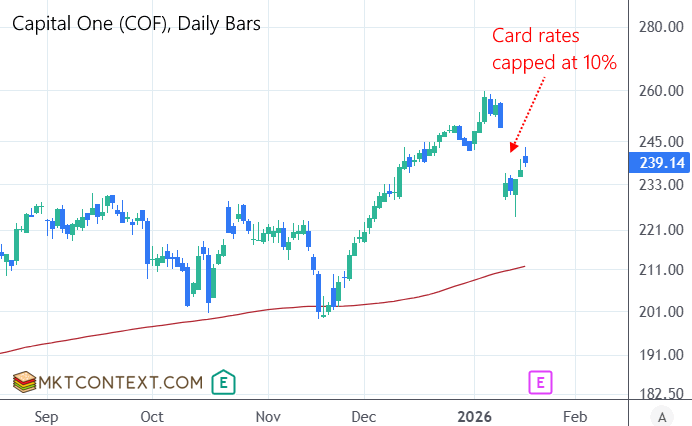

Credit card cap

Last weekend, Trump announced a plan to cap credit card interest rates at 10%. Rates were previously at 23% so this would cost banks a lot. Studies show this would save $100B/year in interest nationwide, in particular for lower-income families who tend to spend more in the economy.

To illustrate: A person with $5000 debt at 24% pays $100 monthly. At 10%, that drops to $41, speeding up payoff.

Card lending is a highly lucrative business. The banks’ share prices all fell on the news, and JP Morgan CEO Jamon Dimon personally spoke out against it. Shares of Visa, Mastercard, Capital One, and American Express were also hard hit.

Prior efforts at such regulation have failed, but it is notable that this time there is bipartisan support. Banks and credit card companies are arguing that borrowers will turn to pricier loans like payday loans or buy-now-pay-later (BNPL). The reality is that expensive processing fees will be cut, along with points rewards programs.

This is the 4th populist measure aimed at easing living costs for Americans — the others being the housing investment ban, drug price cuts, and health insurance premium reductions. Trump also wants tech companies to pay their share of electricity costs, and defense contractors to stop paying exorbitant salaries.

In the era of populism, big business and monopolies get attacked. We noted early on in Trump’s presidency that he would likely come after Healthcare and Defense sectors. Investors need to think twice about owning high-margin businesses that are susceptible to “antitrust” measures. Unfortunately, many of America’s best businesses have strong market power that allow them to generate abnormal profits.

Watch the BNPL stocks and alternative payment providers like AFRM, KLAR, PYPL, and XYZ. They will be the beneficiaries as millions of consumers are steered away from credit cards.

To see our trades and portfolio, consider upgrading to paid subscriber status.

Claude Cowork

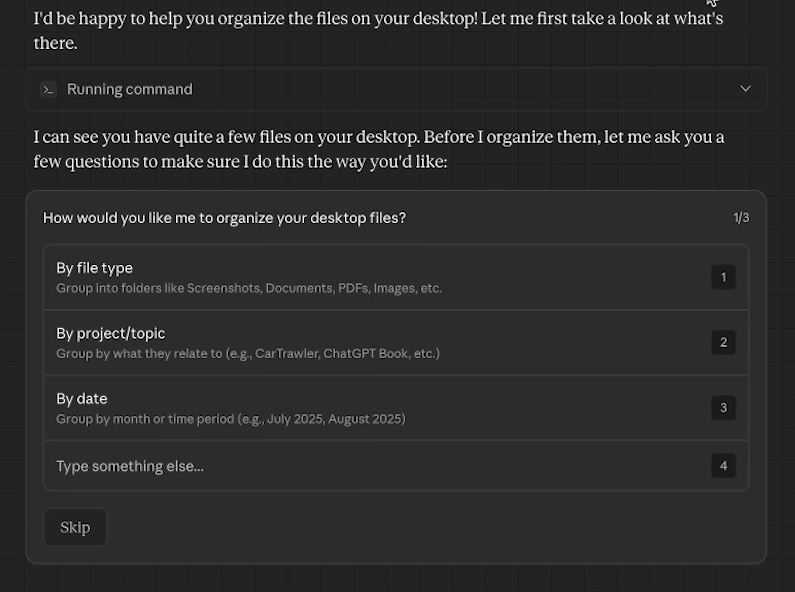

Not wanting to be outdone by Google Gemini 3, Anthropic announced a new feature called “Cowork” that gives agentic capabilities. It can read files and programs on your computer, and link with other apps, allowing for many office and productivity use cases such as:

Extract data from screenshots into spreadsheets

Draft reports from notes

Sort files and email cleanup

General research

When Google’s Gemini 3 and TPU was announced, investors feared what that would mean for GPU providers and the AI capex paradigm. With Claude, it reframes the efficiency and usefulness of software and software programmers. Remarkably, Anthropic built Cowork in about 2 weeks, using Claude itself for AI-assisted coding.

This is what we meant when we said they’ve barely scratched the surface on AI. The bubble simply cannot end here because there’s so much more we haven’t seen yet. As more tasks are replaced with AI, workers will get laid off and owners will profit from cheap digital labor.

This segues nicely into the next discussion of how software stocks are getting killed…

The rest of this article is for premium members. Upgrade now to continue reading:

Software democratized

Netflix bids for Warner Bros

Liquidity rising

Positioning is shifting

Our portfolio and trades of the week

Claim your free trial by clicking the button below!

Keep reading with a 7-day free trial

Subscribe to MKTCONTEXT to keep reading this post and get 7 days of free access to the full post archives.