🍔Indexes Breaking Out! Time to Buy!

The bull market continues; all-time highs incoming

Welcome back to MktContext where we explain what’s happening in the US economy, and use that to time the stock market.

Markets were largely unfazed by the geopolitical risk brewing in Venezuela and elsewhere. But there was no shortage of new news catalysts this week. They have sweeping implications on the economy and stock markets. We discuss some of these developments below.

Above all else, major stock indices are breaking out of resistance to new highs. The bullish angle we’ve been waiting for 3 months is finally happening. We are perfectly positioned to benefit from the run. Let’s see if there will be follow-through.

Today’s topics: Uranium, housing, breakouts, AI rotation, seasonality, and short-term trade ideas.

Uranium enrichment

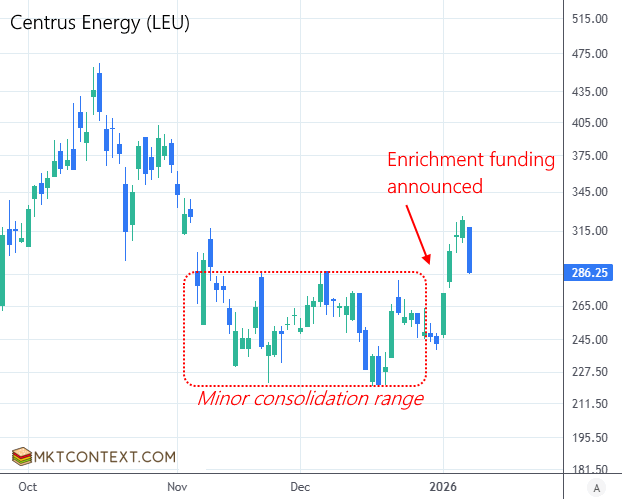

On Tues, the Department of Energy backed $2.7B of deals to boost domestic Uranium enrichment. 3 companies received the funding: Orano (a French-government-owned nuclear firm), Urenco (owned by UK, Dutch, and German governments), and Centrus (ticker: LEU, a small US operator of enrichment plants). All have facilities in the US.

The US wants energy security. Right now it runs 94 reactors generating 20% of the nation’s power. But most of its enriched uranium is imported, with Russia supplying 35% before sanctions.

Most of the world’s enrichment capacity resides in Russia (44%) and Europe (30%). Having its energy supply chain controlled by foreign countries is untenable to the US from a security standpoint. It risks price spikes or shortages if relations sour or wars break out. At least, that’s how the administration views it.

The new DOE deals aim to grow US enrichment capacity to roughly a third of the world. Trump recognizes that AI and military leadership is synonymous with energy leadership. All energy sources (coal, oil, gas, solar, wind, nuclear, fusion, hydrogen) will be needed to power the US’ needs - not just green energy.

Related stocks received a huge boost on the day, with LEU leading the pack. Uranium producers (UUUU, UEC) and nuclear companies (OKLO, NNE, SMR) are all breaking trend higher after a deep three-month selloff. We think dips are buyable for a tactical trade as energy dominance remains a core theme.

To see our trades and portfolio, consider upgrading to paid subscriber status.

Housing reform

Trump has been fixated on fixing the housing market. The US is currently facing an affordability crisis as home prices and mortgage rates have pushed young buyers out of the market. Remember, we are living in a populist era, which drives political and economic change.

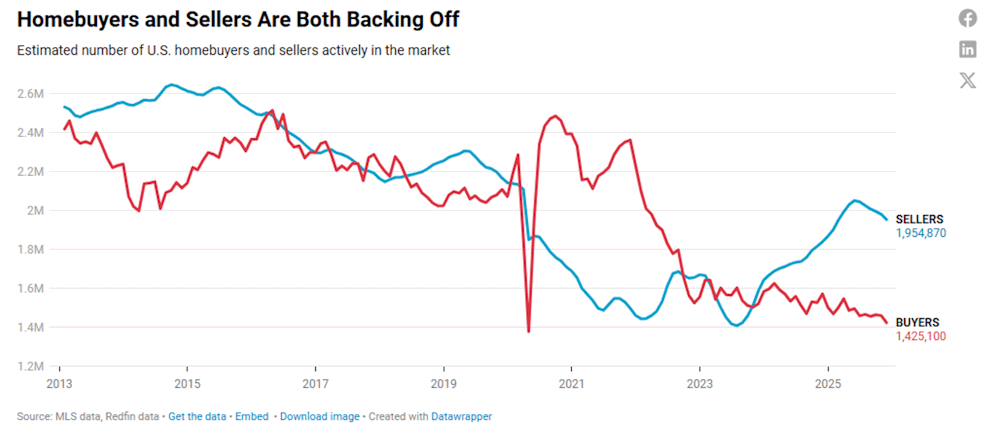

The current situation is one of fewer buyers AND fewer sellers:

Trump has previously floated ideas about portable mortgages, a 50-year mortgage, as well as deregulating banks which should in theory ease borrowing requirements. He has talked about releasing Fannie Mae and Freddie Mac (government sponsored mortgage backers) to expand lending capacity while speeding housing development. These demonstrate his priority to boost housing affordability and availability.

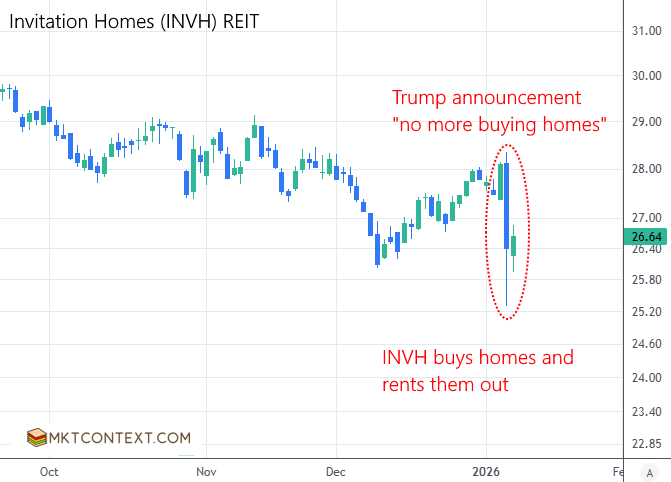

The newest idea is to ban institutions from owning houses. Over the last decade, big firms (like private equity) have bought tens of thousands of homes to rent out, tying up housing supply. It’s a very “Main Street over Wall Street” move and precisely the type of change that populism brings about.

The move had an immediate effect on stocks like Blackstone (private equity firm), Opendoor (real estate flipper) and Invitation Homes/American Homes 4 Rent (public REITs that own homes).

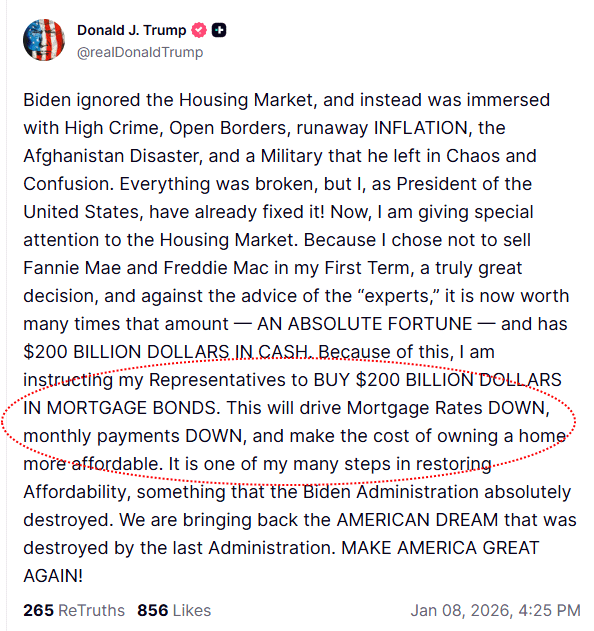

The next day, Trump ordered Fannie Mae and Freddie Mac to buy $200B in mortgage bonds. You can tell from the ALL CAPS he uses below, that this is an important issue! Jokes aside, this should tighten spreads on mortgage bonds and help lower borrowing costs slightly, without the Fed directly cutting rates.

The point we’re trying to make is that this could create movement in the economy. Many homeowners are “locked in” to cheap mortgages and can’t move or refinance. If new buyers get easier access and existing owners can sell, it sparks activity: sales, renovations, furnishing, spending. That velocity helps unstick the market. And since housing costs make up a big part of CPI, it should push inflation down too.

You might think this is good for homebuilder stocks, but margins will get compressed and they end up competing on volume. They aren’t the best expression of the trade.

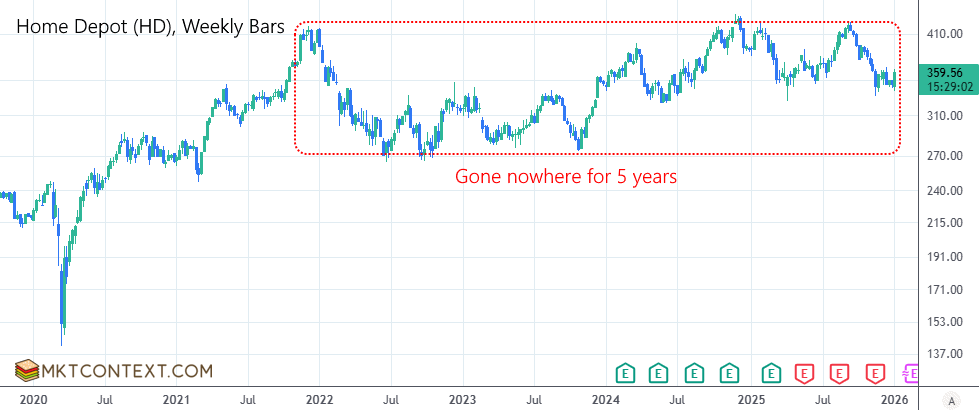

On the other hand, various industries benefit from housing activity: e.g. building-products, regional banks, and discretionary retailers (think Restoration Hardware or Home Depot). These stocks have largely gone nowhere for 5 years and are waiting for a catalyst to break out. This is a multi-year thesis, not necessarily a 2026 story.

Update on precious metals short

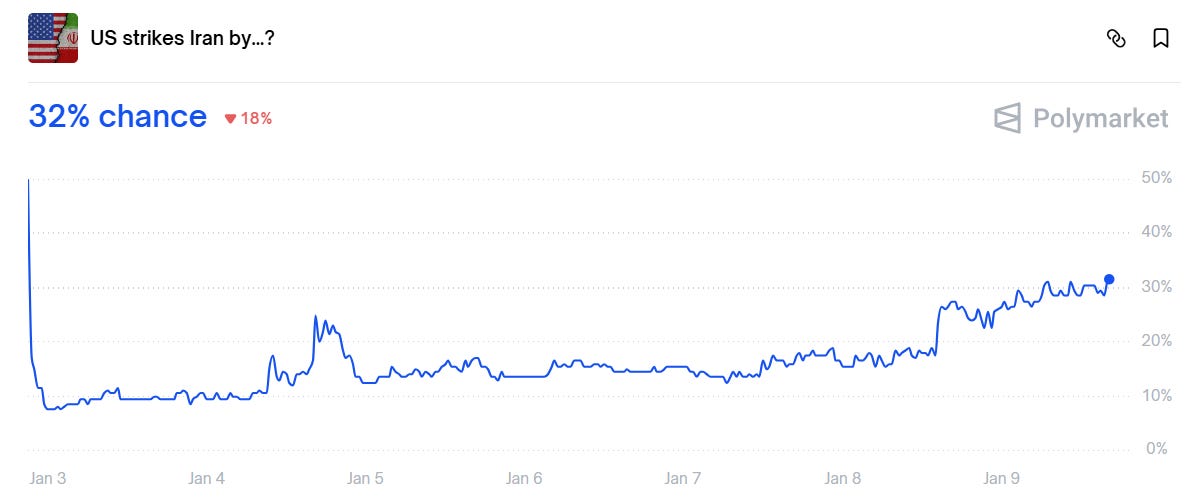

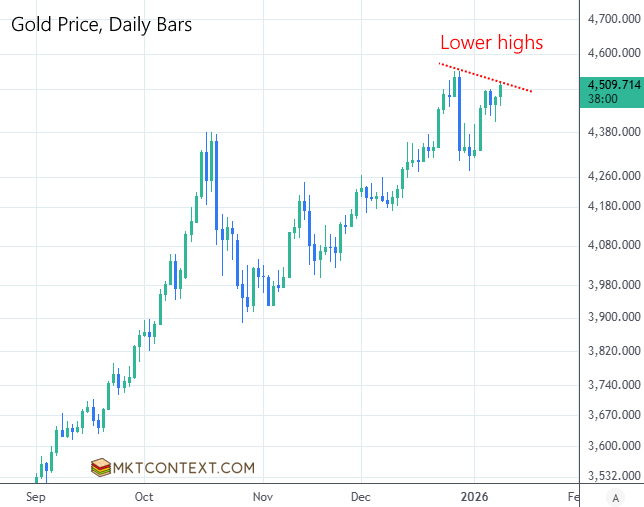

Our precious metals short was in the money for a few days until the Venezuela news came out. Investors are being reminded of Russia/Ukraine in 2022, and have suddenly become fearful of war. Odds of US striking Iran, taking Panama Canal, and acquiring Greenland have suddenly shot up. In times of geopolitical uncertainty, people flock to gold and silver.

On the bright side, the highs in gold and silver (set prior to CME margin raise) remain unbroken despite strong buying. We think Venezuela was a unique event which does not open the door to incursions elsewhere. Therefore we are still short, but with lower conviction. A break of the highs means we are wrong.

The timing was unfortunate, but that’s how trading goes sometimes.

Big breakout in indexes…

The rest of this article is for premium members. Upgrade now to continue reading:

Indexes breaking out

AI rotation continues

4 trade ideas

Technical analysis and our portfolio

Claim your free trial by clicking the button below!

Keep reading with a 7-day free trial

Subscribe to MKTCONTEXT to keep reading this post and get 7 days of free access to the full post archives.