🍔Gold and Silver Lose Shine

Plus: Venezuela incursion is not what it seems

Precious metals collapse

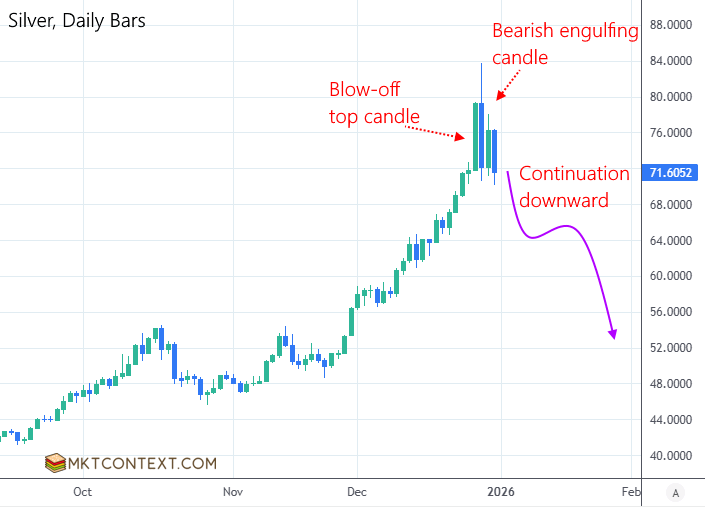

The precious metal short given last week was right on the money. Gold, silver, platinum, and palladium were all over-extended and collapsed from highs. After a final blow-off-top candle, bearish engulfing candles formed on all charts (the bearish candle completely covers the prior day’s bullish candle). The exhaustion top is formed…

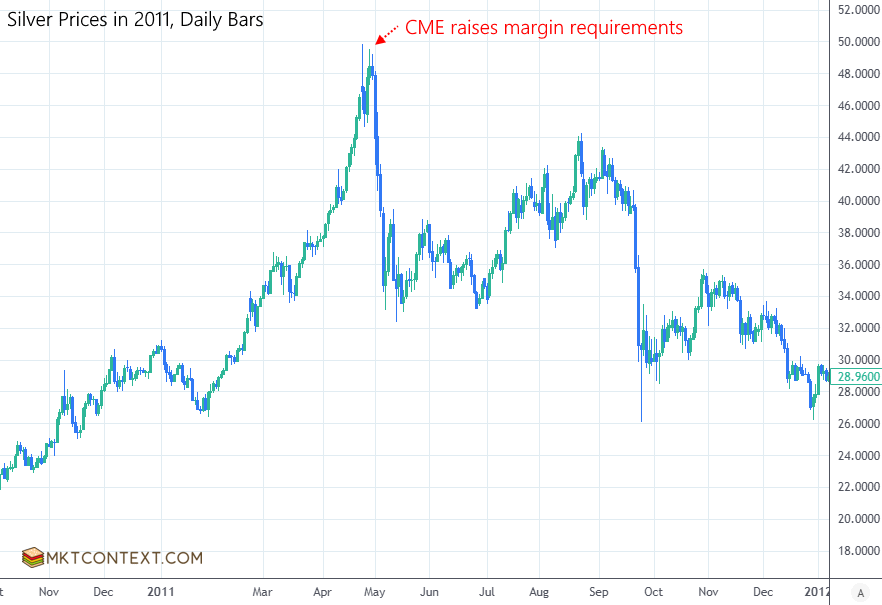

The CME raised margin requirements on precious metal futures trading again; the second time within a week. This meant traders needed to shrink position sizes, forcing some to sell over-levered positions. In the past, the CME raised margins as many as 5 times in succession in order to stop speculative activity. When they did this in 2011, it marked the exact top in precious metal prices:

What exactly constitutes speculative activity to the CME? Pretty much any time prices are rising too high too fast. The CME is essentially saying they want lower prices and will continue to raise margins to get there. They’re like a persistent, price-insensitive seller.

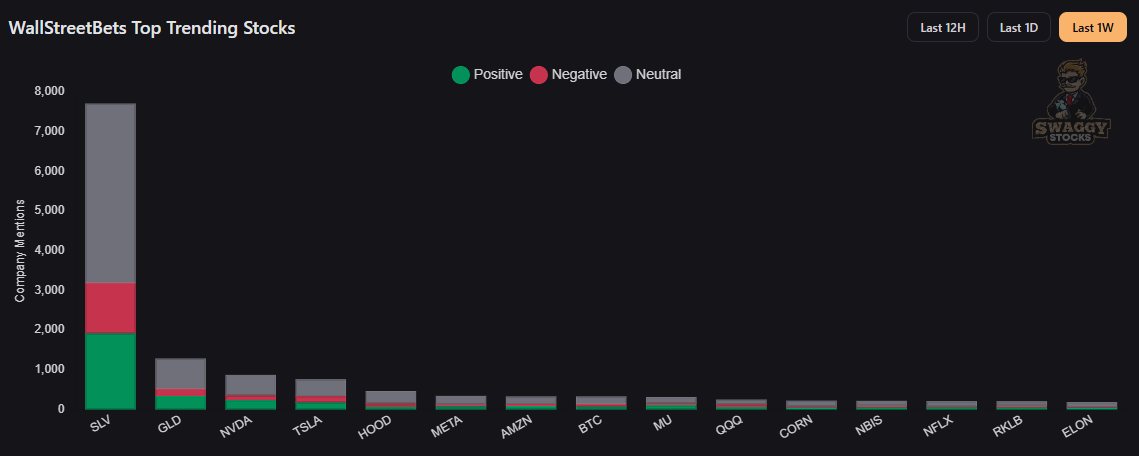

CME’s concerns about speculative trading are not unfounded. Silver and gold are the most traded stocks on the WallStreetBets (WSB) Reddit community. This subreddit is infamous for YOLO-style, leveraged, high-risk/high-reward plays. This tells us speculative retail interest has been a driver of the parabolic rise.

In commodity mining, there is a thing called marginal cost. This is the all-in cost of extracting ore from the ground, including fuel, labor, and capital equipment. The marginal cost to extract silver is about $30/oz. There’s a huge profit incentive for miners to extract it for $30/oz and sell it for $70/oz, so they ramp up production. This increases supply in the market and regulates prices.

By the same token (coin?) prices should gravitate back to their marginal cost. Producers will produce until there is no profit margin left. It is no coincidence that silver has stayed in the $30 range for much of the past 5 years, up until the recent breakout.

Furthermore, silver is often obtained as a free by-product of copper, gold, zinc, and lead mining. As other minerals get mined, silver supply is increased. Several big mining companies have already raised their production estimates for 2026 and beyond. You can imagine what this will do to silver prices in the medium term.

Attack on Venezuela

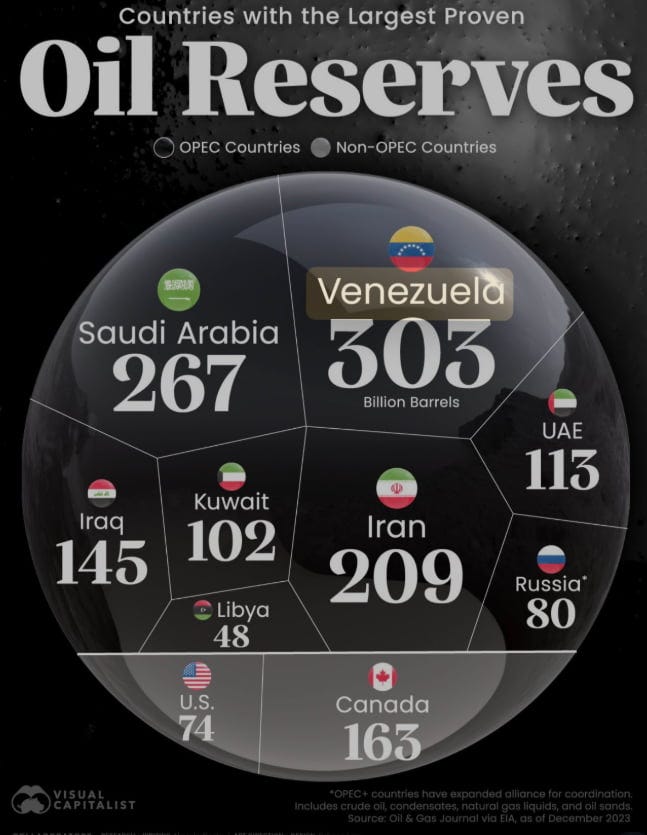

Early Saturday morning, we got news that the US launched air strikes on Venezuelan military sites and captured Nicolas Maduro alive. They then took over control of the massive oil reserves in Venezuela, which makes up a whopping 20% of the world’s reserves, larger than Saudi Arabia or Iran.

A lot of people think this is just about accessing vast oil reserves. The reality is that the physical oil infrastructure in Venezuela is in a state of disrepair. Pipelines haven’t been maintained in 50 years. Restarting production will take at least 5-10 years and require billions in investment from US oil majors.

The oil majors like Exxon and Conoco have massive legal claims against Venezuela. They lost billions of dollars when oil assets were expropriated by Hugo Chavez in 2007. Even if they can settle these claims quickly (Trump has said the oil revenues will go toward paying for the military exercise and settlements), companies will think twice about committing new capital to a country that is currently a conflict zone.

With oil prices at $57/barrel and global oversupply risks looming, private companies will understandably shy away from investing. This means Venezuela’s oil production is unlikely to ramp up quickly, despite Trump’s intentions.

So if not for oil, what was the point of the incursion?

We explained in last week’s note Trump’s motives and how it affects relations with China. China illegally buys oil from Venezuela via “shadow tankers”. That oil is difficult to track, and very cheap because of sanctions. That stream will now get diverted to US Gulf Coast refineries who benefit from the lower shipping cost and higher quality yield.

Ever since sanctions on Venezuela in 2019, US refiners have been buying expensive “heavy” crude oil from Canada and the Middle East. So now they switch over to cheaper Venezuelan imports. China, having lost their Venezuelan supply, will just switch over to the expensive Canadian and Middle East imports. It’s called musical chairs — the oil swaps owners, but everyone still gets their oil.

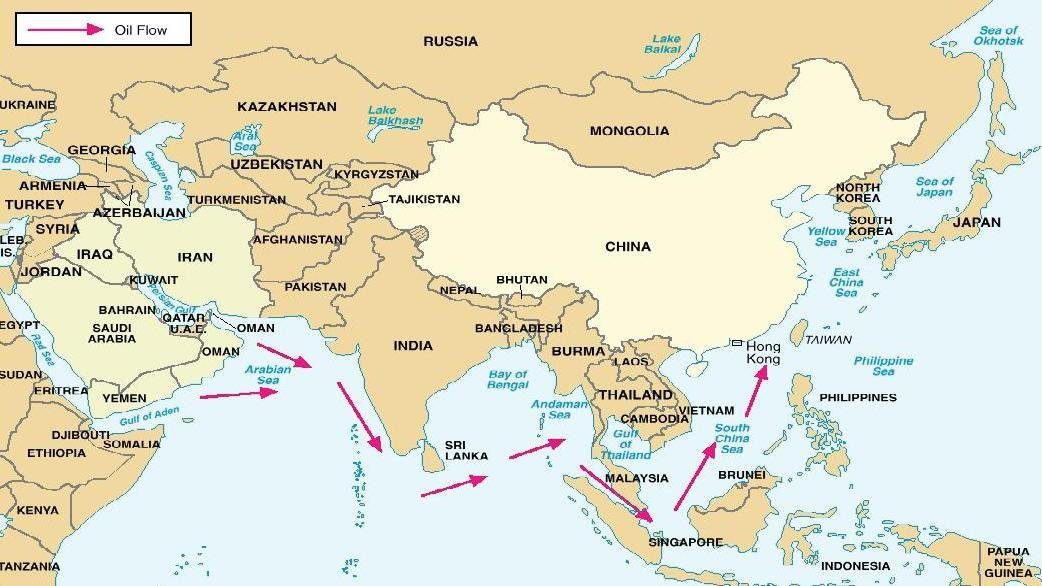

Except the geopolitical leverage has shifted. When China imports from Canada and the Middle East, those two shipping lanes are heavily controlled by the US. China’s biggest fear is the fact that the US Navy can block the narrow Malacca Strait in a war, cutting off their supply of Middle Eastern oil. 80% of China’s oil comes through Malacca.

To be clear, Malacca has always been a known issue for China. Losing Venezuela (which was about 6% of their oil) just forces China to be more dependent on the very shipping lanes the US already controls. It limits their strategic and military options, for example if they wanted to invade Taiwan.

Does it stop China from getting oil? No. But it makes their energy more expensive, harder to refine, and easier for the US to cut off in a potential conflict. And by taking control of Venezuela, the US removes a pro-China, pro-Russia, pro-Iran military foothold in the Western Hemisphere.

Oh, and we’d be remiss not to mention that Canada would lose some leverage if the US no longer needs their heavy oil. This will impact the upcoming USMCA renegotiations in July of this year.

That’s it. The whole thing is a geopolitical play that cleverly hits three birds with one stone. The oil is secondary.

Bringing it back to stocks, Chevron (CVX) is the only major oil company that could slightly increase oil production in Venezuela, given they already have a presence down there.

Gulf Coast refiners such as Valero (VLO), Marathon (MPC), PBF (PBF), and Phillips 66 (PSX) have refineries specially equipped to process Venezuelan heavy crude, and should benefit from the initial reroute. Venezuelan crude is chemically superior to other heavy crudes because it is less corrosive to metal and also yields more diesel and jet fuel. The proximity of Venezuela means they save on shipping to the Gulf Coast as well.

The rest of this article is for premium members. Today’s post covers:

Tax relief to provide fiscal stimulus

Consumer confidence conundrum

Rotation out of AI continues

Technical analysis and our portfolio

Claim your free trial by clicking the button below!

Keep reading with a 7-day free trial

Subscribe to MKTCONTEXT to keep reading this post and get 7 days of free access to the full post archives.