🍔War on Christmas

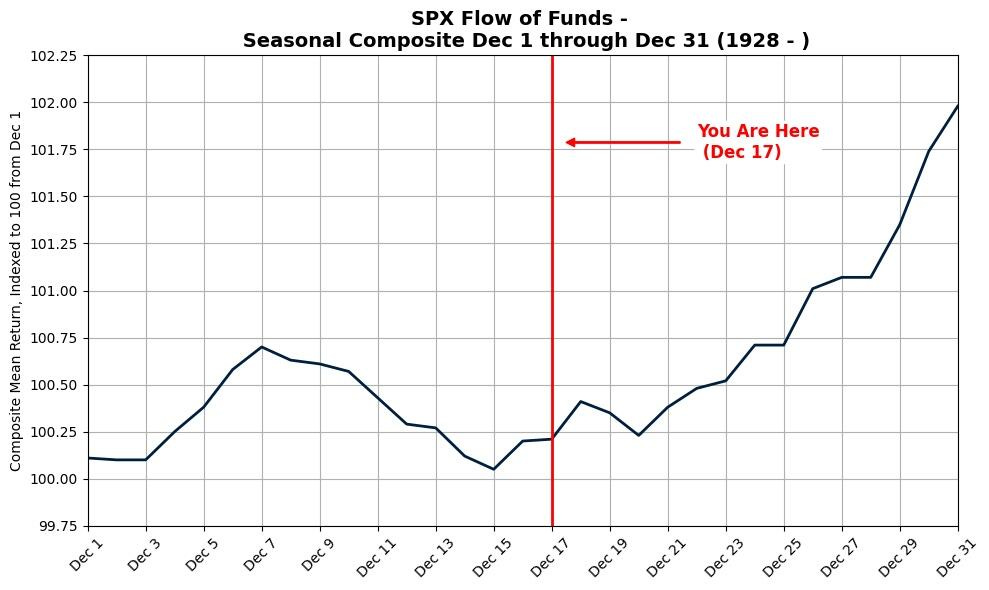

Santa rally came just in time

As we predicted, the Santa Claus rally is on! This week the SPX made an impressive recovery after last week’s tech-led selloff. We were expecting a bullish end to 2025 based on seasonal patterns, and Santa delivered:

We are seeing a possible resumption of the data center/AI bubble. Last week we had news of CoreWeave joining the Genesis Mission. This week was a breakout in NVDA. Investors have been concerned about the AI capex cycle and this could be the light at the end of the tunnel.

Finally, gold and other precious metals have been on a tear lately. We believe a blow-off top is forming. There is high risk of a major bearish reversal in the coming week. More details in the note below.

But first, let’s talk geopolitics…

Attack on Venezuela

What better way to start an X’mas article than talking about war? The US is tightening pressure on Venezuela by seizing oil tankers that are illegally sending oil to China and Cuba. What started as an interception of drug boats has escalated to choking off 900K barrels per day of oil exports. This was backed by talk of a no-fly zone and more military assets in the Caribbean.

Venezuela relies on a shadow fleet of 400 tankers to export oil to China and Cuba. The fleet is kept under the radar, with their origin and destination hidden. It’s the main source of cash for Venezuela’s dictator Nicolás Maduro. Cuba and China both rely on this cheap oil, so Trump sends a giant middle finger to major political rivals. China has condemned the move as “seriously violating international law” as it directly threatens her energy security.

Trump has two key objectives. The first is to sever ties between South America and China (and to a lesser extent, Russia). China has long benefited from the cheap resources, taking in 80% of Venezuela’s exports. Toppling the Maduro regime opens up the throne for a more US-friendly leader. The message is clear: the Caribbean and nearby seas are still an American backyard.

Deploying military forces to Venezuela, regardless of reason, also makes Trump look strong on national security in a midterm election year. This comes after failing to end the Russia-Ukraine war in a way that would lower energy prices. It wins the minds of voters who like tough talk against socialist or anti-US rivals.

The second objective is to shape world oil prices in a way that benefits US consumers and political allies. Trump has been getting chummy with Saudi Arabia, who earlier this year committed to investing $1T into the US economy. Restricting Venezuelan supplies helps OPEC increase production and regain global oil market share without prices plummeting.

To be clear, there is a sweet spot in oil prices that is high enough for US and Middle East drillers but low enough that American voters don’t suffer from runaway inflation. Affordability is a key concern for voters this term. Oil prices affect nearly everything people buy, from food to transport, so striking this balance is key.

Here’s where things get a bit dicey. The Venezuelan Navy has been sent to escort the tankers out of the blockade; any interference from US vessels will be deemed an act of war. The US quietly allowed them to pass. At the same time, Russia pledged support for Venezuela and has been sending their own tankers into Venezuelan waters. Daring the US to trigger war with a nuclear superpower. Again, the US quietly allowed them to pass.

What happens next in this standoff is anyone’s guess. But the market implications should be clear. We said the US/China deal back in Nov was an uneasy truce and this is the clearest evidence of that. Expect more geopolitical posturing and escalation in the near future.

Contrary to the popular narrative, this posturing does not signal an imminent US incursion on Venezuela. Trump opposes large ground wars and prefers pressure and negotiation. But make no mistake, the aim is to weaken both Venezuelan and Cuban governments financially, with the hopes of installing more US-friendly leaders without a full-scale invasion.

The rest of this article is for premium members. Today’s post covers:

Runaway GDP growth

Nuclear fusion

Gold too extended

Nvidia rebounding

Year end predictions and our portfolio allocation

Keep reading with a 7-day free trial

Subscribe to MKTCONTEXT to keep reading this post and get 7 days of free access to the full post archives.