🍔(We're Back!) A New Breakout

Our SPX target $6,000 has been reached

First and foremost, my sincerest apologies for the hiatus in posting. I have been dealing with a personal emergency that required my full attention these past few weeks. Appreciate your patience and understanding during this difficult time.

We’re back to our regularly scheduled posting and we have some exciting changes to announce! We are expanding our Sunday post with more and better content for premium subscribers (stock picks, market timing, trading technique, and more!). We will also no longer be publishing the midweek post, and instead rolling that into Sunday. We heard you loud and clear that you want more actionable items from MktContext!

Before we get into the market, we have a poll. Please take a moment to answer, as this tells us what trading content would help you succeed. It just takes one click:

As we predicted a month ago in this post, SPX reached exactly $6,000. Those who have followed our trades in QQQ and IWM back in August have seen even more outperformance as those tickers have beaten the SPX since we bought them here. Our simple market timing strategy continues to work!

In today’s note we will discuss what the market’s next steps will be, including how to position for upcoming moves and how to prepare for the pullback.

Trump 2.0

As investors we don’t worry about who should be in office or why they’re there, but rather who is in office and what that means for markets. The Trump win was unsurprising given the rise in populism and the lower/middle class’ struggle with inflation, which we wrote about before. This will color the policy agenda for the next 4 years. Our thoughts below do not reflect our political alignment, so don’t @ me. Put aside your personal political beliefs. Markets are, and always will be, agnostic.

The consensus is that a Trump win + red sweep is positive for consumers and businesses due to lower taxes, less regulation, protectionism, and more fiscal spending. Remember after the 2016 election there was a strong view that "animal spirits" would be ignited. That could happen again today. As we wrote before, small businesses have been waiting for election clarity before investing and hiring. The lower regulatory hurdles and “America-first” protectionism will give them the cover to resume growth — great for earnings.

The market is intensely concerned Trump’s fiscal spending could throw us into a debt spiral or reignite inflation. We think this is misguided for a few reasons. Firstly, a sustained rise in inflation typically requires an external shock such as war or oil embargo. Right now, war isn’t on the cards and OPEC is sitting on plenty of spare capacity. Additionally, Trump is pro- oil & gas drilling which will increase supply and lower a key cost input for almost all industries. With inflation a prominent concern for populist America, Trump has the incentive to reduce it.

Secondly, Trump made his deficit stance clear in his victory speech: “We’re gonna be paying down debt.” He said the same thing in 2016, but that was forestalled by emergency Covid spending. Reducing the deficit allows Trump to further cut taxes and project economic strength on the global stage, which is crucial for “Making America Great Again”. He can’t have a falling Dollar and creditworthiness in jeopardy.

So how will Trump accomplish this feat of reducing deficits while also cutting taxes and increasing fiscal spending? It will likely come at the expense of the two largest government outlays — Healthcare and Defense. Both industries are known to be very profitable, and Trump has attacked that in his first term. For example, he overhauled the kidney dialysis industry as this is one of the most profligate line items for Medicare and Medicaid. In Defense he shifted costs to contractors while calling for NATO allies to step up their share of defense spending. You can debate the merits of these policies all you want, but it is clear that cost-cutting is a top priority of Trump’s.

I would be remiss to ignore the proposed “government efficiency” org headed by Elon Musk. Musk claims he could cut $2T from the $6.5T budget, and given his history at Twitter (where he cut the workforce by 80%) I wouldn’t underestimate this claim. Again, we can debate whether that’s the right thing to do, but don’t discount a scenario where taxes are cut, fiscal spending is increased, and the debt burden shrinks via job cuts and restructuring. A UK-style “Debt Armageddon” appears overblown.

Deficits are bad for markets, and Trump’s advisors are all capitalists. Trump has sold puts on the markets and we would do well to do the same. Long risk assets, small caps, financials, and domestic businesses.

One significant area for concern is mega-cap technology. Recall the Trump administration filed antitrust cases against Google and Facebook in 2020. He’s shown a willingness to attack the monopolies that tech companies currently enjoy. He may also have a personal vendetta against these companies for being politically biased against him, especially as he believes these information service companies cost him the 2020 election. We’ll have more on these developments in the coming months.

Fed remains dovish

As expected, the Fed cut rates by 25bps. And as usual, the press Q&A gave us great insight into the future of monetary policy.

When asked if 4 rate cuts in 2025 is reasonable, Powell stated they are “on a path to a more neutral stance”. Based on previous commentary we can infer neutral is around 2.5-3.5%, so there are more cuts coming. This is crucial, since economic data continues to be resilient and the market’s fear is that the Fed could start hiking again. A “pivot to the pivot” as it were.

The second insight is that Powell is not worried about long-term interest rates. Since September the 10-year yield has risen nearly 90bps from 3.6% to 4.5%. When asked if this derails the Fed’s path, Powell stated: “the moves are not principally about higher inflation expectations, they’re really about stronger growth and perhaps less in the way of [recession].” And yes, that is the Fed Chair telling you recession risk is fading. But the key takeaway is that higher long-term rates is not inconsistent with their disinflationary outlook.

Powell also answered questions about the election and said he’s not going to be fired or resign (duh!). It’s a subtle hint that the Fed will continue on its dovish trajectory, unimpeded.

It is interesting to consider the cross-currents of fiscal and monetary policy. When asked about this, Powell stated that Trump’s election would have no effect on the Fed’s decisions. Again, markets have been worried that inflationary fiscal policy would force the Fed to hike again, but this is not the case (at least not until sustained inflation shows up in the econ data).

All-in-all, this week’s FOMC meeting showed a Fed that is on track to continue supporting equity markets. Interest rates promptly fell from 4.5% to back under 4.3% as the market breathed a collective sigh of relief.

Share this post with someone who wants to earn money in the stock market:

Interest rate fears

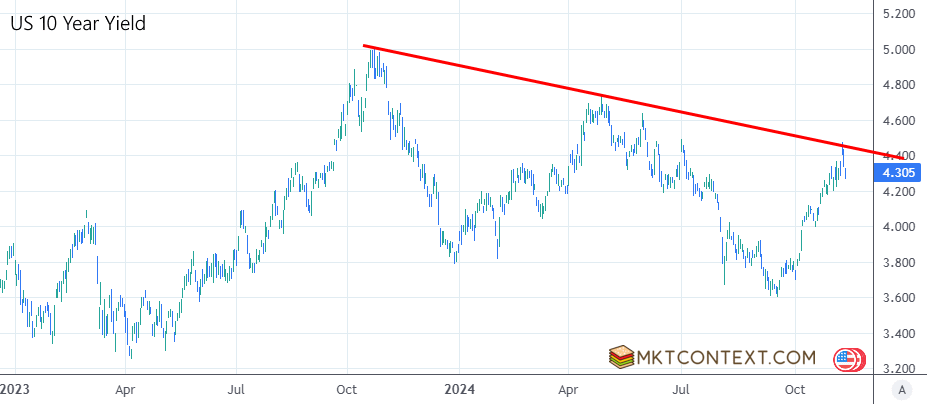

We previously warned that a sustained break of 4.3% in the 10-year yield would spark a SPX selloff (we’ve posted the below chart showing the last two times that happened). Indeed, a break and a selloff occurred for a brief moment in the last week of October as markets priced out rate cuts and priced in inflationary concerns.

Now, the 10-year rate is sitting right at the critical 4.3% level, but has respected this year-long downtrend since the peak of 5% in Oct 2023. This downtrend needs to hold in order for SPX to remain supported. We think it will, since the key components of inflation (housing and durable goods) are still coming down and the economy appears to be slowing.

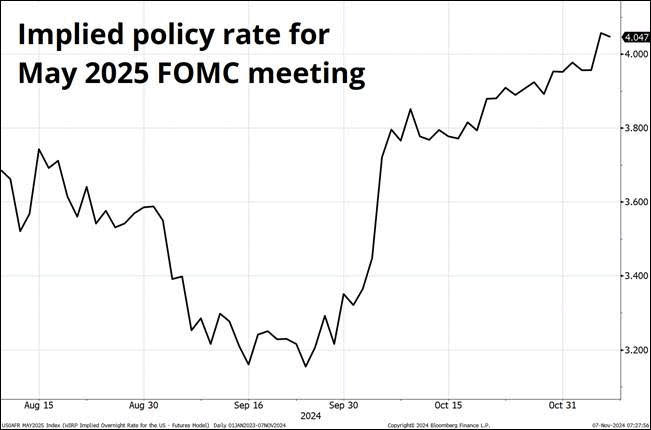

As Powell said, the rise in interest rates has been because of growth acceleration, not inflation. That’s an important distinction that is net positive for stocks. We said previously that rate expectations were too low which would hamper stocks, but after a sharp repricing (chart below) markets’ expectations are much more reasonable. That turns a headwind into a tailwind for stocks in the coming year.

Goldman Sachs is wrong

A few weeks ago Goldman Sachs published a very punchy SPX forecast of 3% for the next decade. That had equity investors in a stir. Just for fun, I thought I’d highlight their prediction from last year that SPX would end 2024 at 4,700 (we’re now at 6,000, off by 28%)…

Key to the bank’s “lost decade” forecast is the high P/E valuation and the sustainability of Mag7 returns. The problem with these forecasts is, valuation is a notoriously bad timing tool because stocks can stay overvalued for a long time. So even if stocks look overvalued, that doesn’t mean sell. In fact, it’s often better to go with momentum and buy at highs.

Another component of their forecast is margins. Historically margins would mean-revert due to cyclicality, but those days are gone. With internet and software monopolies dominating the world, margins are structurally higher and less mean-reverting:

Higher earnings + higher P/E means stocks can stay overvalued for very long periods.

As a general rule, it’s fine to have forecasts but they need to be confirmed by price action. Otherwise you are simply praying that your forecast will play out. It’s better to wait for margins to start contract, and markets to start falling, before selling. This isn’t Roulette; you’re allowed to wait for the ball to land before placing your bet.

Q3 earnings disaster

The rest of this article is for paid subscribers. Upgrade now to continue reading the rest:

Q3 earnings disaster

ETF flows

New technical analysis

Our portfolio is outperforming!

Claim your free trial by clicking the button below!

Keep reading with a 7-day free trial

Subscribe to MKTCONTEXT to keep reading this post and get 7 days of free access to the full post archives.