🍔Thesis Confirmed! Growth is Coming

The continued cries of recession are misguided; there's evidence the economy is good

Welcome back Traders,

We are writing this as of the close on Weds, July 17th with the SPX down -1.3% on the day. The SPX has been rangebound for two weeks. In our last post “Unstoppable Force: Bull Run Far From Over” we predicted that SPX would chop sideways or sell off in the very short term, due to our Skew signal firing:

Options skew is a “topping” signal that I like to use for short-term trading. Every time this signal spikes, the market will either go down or sideways. This intuitively makes sense because traders scramble for hedges, which sucks out buying flows.

During these periods that typically last 5-10 days, traders should switch to mean-reversion trades while investors should be on alert for an exit signal (e.g. break of 50d moving average). We just triggered a spike in skew on July 10, which means the next week should be choppy.

Quote from MktContext, July 15

Before we dive in, please help us grow by liking this post on Twitter @mktcontext and sharing with an investor you know! It really helps a lot :)

Economic data confirming our thesis

After the positive jobs report (Jul 5), inflation cooling (Jul 10), and strong retail sales (Jul 16), we have more proof the US economy is resilient while inflation is cooling (our thesis here). This sets up the Fed to finally start its rate cutting cycle, so the debate should shift to the number of cuts. We think it will be shallow (i.e. only a few cuts), a reality which will spook the mkt later this year.

Lately the mkt has become concerned about recession. That may seem contradictory with the SPX near highs, but this is indeed what the internals are telling us. Sure, there is anecdotal (cherry-picked!) evidence of deceleration. But in case I haven’t been clear, we are NOT heading for a recession. In fact, there could be a meaningful reacceleration in economic growth later this year. Hence why we think the rate cutting cycle will be shallow (Fed can’t cut too much if growth is still strong). This means cyclicals, financials, industrials, and small caps should perform well.

Why do I think growth will bounce back? Let’s go back to retail spending data. While there is weakness in low-income consumer cohorts, the middle- and upper- cohorts are doing well. Here’s what Bank of America, the second largest bank in the country, said about consumers:

Excess deposits stored in cash and investment securities: Cash levels of $321B remained well above pre-pandemic ($162B in 4Q19).

Bank of America 2Q24 Earnings Presentation, July 16

In case it wasn’t explicit, Americans in aggregate have twice as much cash lying around than in 2019. Oh and let’s not forget, banks’ earnings have been surprising positively, which only happens during good times. Here are more banks chiming in:

Wells Fargo: “Consumers have benefited from strong labor market and wage increases.”

Citibank: “We have the higher FICO score customers that are driving the spend growth and that, frankly, have still continued strong balances and savings.”

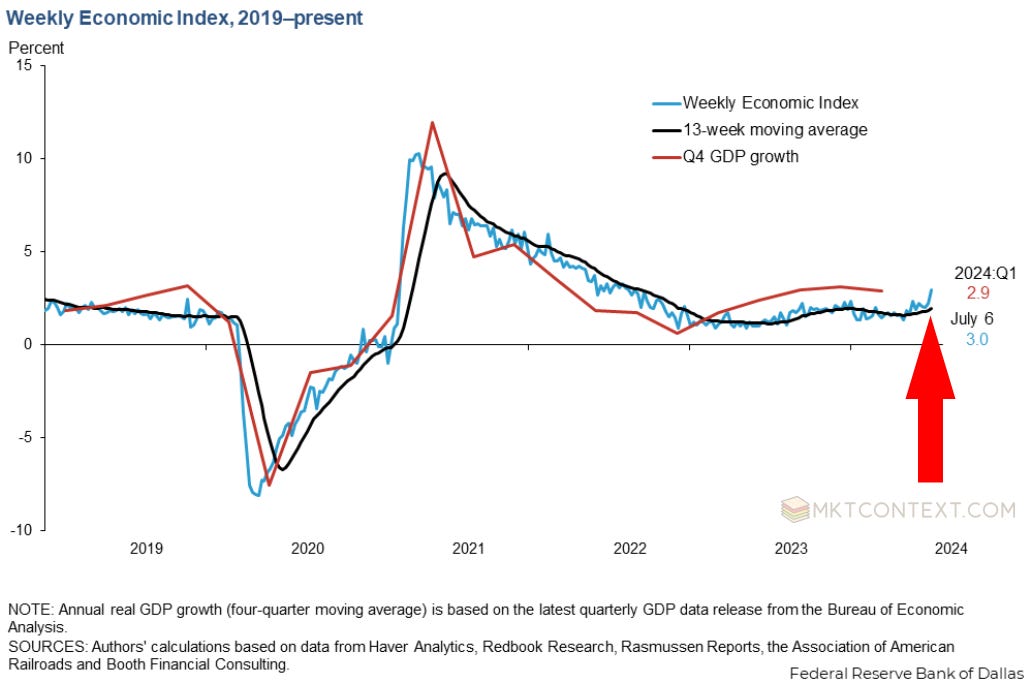

The Dallas regional Fed publishes a weekly economic indicator that signals the state of the US economy. Their latest reading shows a reacceleration to 3% real GDP growth (thanks to @AndreasSteno on Twitter for pointing this out!). To quote Andreas, these are things that do NOT happen during a slowdown!

One more thing that I think will catch the mkt off-guard: manufacturing activity is recovering after a long slump. Based on ISM manufacturing data, it is becoming clear that customer inventories are normalizing post the Covid distortions. This means companies will need to rebuild by buying inventory (thanks to Tian Yang from @VrntPerception on Twitter for calling this out - watch the full video here).

So with the consumer flush with cash, economy growing at a nice clip, and manufacturing activity recovering after a long slump, where is this recession everyone keeps calling for?

That’s it for the free preview! You can read the full post by upgrading to a paid subscription (free trials available!). If you enjoyed this so far, support us by liking this post on Twitter @mktcontext and sharing with an investor you know! It helps us a lot!

Subscribe now to continue reading this article, which discusses these topics:

The short squeeze starts now

Powell can finally breathe

Looking for an exit signal

How to trade a possible breakdown

Keep reading with a 7-day free trial

Subscribe to MKTCONTEXT to keep reading this post and get 7 days of free access to the full post archives.