🍔The Quiet Rise of Magnificent 7

Plus: Upcoming portfolio changes inside!

The SPX pullback that we called for last week is now here. Once again, the put/call skew ratio has proven eerily accurate. As noted last week for premium subscribers:

Something strange is happening in the markets. Only the largest stocks are rallying while the rest of the market is not participating. With the bigger indexes getting a bit stretched, a short pullback would be normal and healthy.

Coupled with the put/call skew being elevated, there’s a good chance we pull back or at least go sideways for the next week. P/C ratios are rarely wrong.

-From December 8th post

Short term traders have done well to switch to mean reversion trades as we recommended. The good news is the market remains well supported so we haven't had to exit long term holdings. Later in the post we'll go over the next phase of our strategy.

In today’s post: What’s driving the Magnificent 7 rally, a possible momentum crash, our thesis on IWM, upcoming portfolio changes, and more!

The quiet rise of Magnificent 7

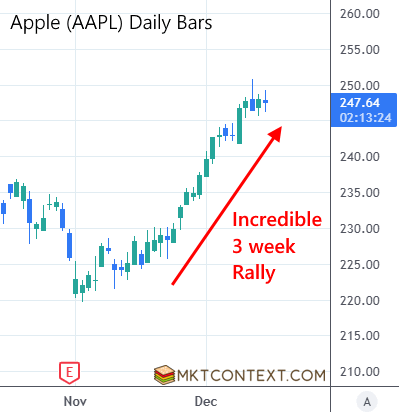

Surprisingly, there’s been little discussion around the Mag 7 stocks lately. For the past while, they’ve been the only stocks going up; giants like Apple (pictured below) and Amazon enjoyed an incredible three-week rally. Meanwhile, the rest of the market is sideways or down. We called out this bad breadth last week, pointing out the low number of stocks trading above their five-day moving averages. So why is this happening, and why can no one explain it?

The move in Mag 7 isn't rooted in fundamental changes or earnings. Sure, Google announced a shiny new Quantum chip, but that doesn’t explain all of it. What we’re witnessing is a volatility-driven re-leveraging in SPX and QQQ (and Mag 7 by extension). Specifically, VIX was crushed from $23 all the way to $13, largely due to the roll-off of presidential election hedges that traders had put in place. We briefly discussed the implications of this VIX roll-off in this post shortly after the election.

As VIX fell, market makers reflexively unwound their hedges while volatility-targeting funds had to re-up equity exposure. The chart below of vol-targeting funds shows the sharp rise to its highest levels (Credit: @neilksethi on X). This surge in buying naturally flowed through to the largest stocks (i.e. Mag 7) which were the most liquid and concentrated within the index.

Don’t take this as a signal to buy more Mag 7, because unfortunately the party is ending. The group just just completed a measured move, a technical pattern that predicts how far the price will move. Note in the chart below that Mag 7 rallied 10% after the election, followed by a two-week consolidation forming a wedge/triangle. When that triangle broke to the upside, it expects to make a symmetrical 10% move… and that’s exactly what happened:

Now, with vol-targeting funds maxed out, the momentum in Mag 7 appears to be peaking and market breadth is deteriorating rapidly. We suspect that the rotation we predicted two weeks ago (albeit a bit prematurely) is about to unfold. Read further for portfolio implications…

Momentum crash…

The rest of this article is for paid subscribers. Upgrade now to continue reading:

Momentum crash

Inflation under control

Interest rates still volatile

Small business optimism soars

Low income consumers are not happy

IWM thesis broken?

Housing collapsing

Upcoming portfolio changes

Claim your one week free trial below!

Keep reading with a 7-day free trial

Subscribe to MKTCONTEXT to keep reading this post and get 7 days of free access to the full post archives.