🍔New All Time Highs

We are dip buyers on any tariff-related bad news

As we predicted, SPX broke to new all-time highs. Since our buy signal on April 13, SPX is up 14% and QQQ is up 19%. We are still fully invested, and subscribers who followed us are now sitting on a very nice cushion of gains.

Our bullish thesis is playing out as expected. We identified early on that the market was overly bearish in positioning, which would trigger a short squeeze in May. Furthermore, we posited that a bull market was in the making as trade war concerns faded. In that post, we gave technical analysis to support the bullish case as well.

Bull thesis intact

We currently remain on our long-term bull signal. Many of the worst-case geopolitical and policy scenarios (tensions with Iran, fiscal cuts, tariffs, deportations, AI capex deceleration) have passed without damage. Historically, after major geopolitical shocks, markets rally in the subsequent 6-12 months.

The key reason markets rallied so much this week was because of lower oil prices (and hence lower inflation) keeping the prospect of rate cuts this year. In response to the Israel/Iran ceasefire announcement, rate cut expectations jumped up to the highest in six weeks and stocks rallied hard. The market’s resilience and capital inflows suggest the rally is likely to continue.

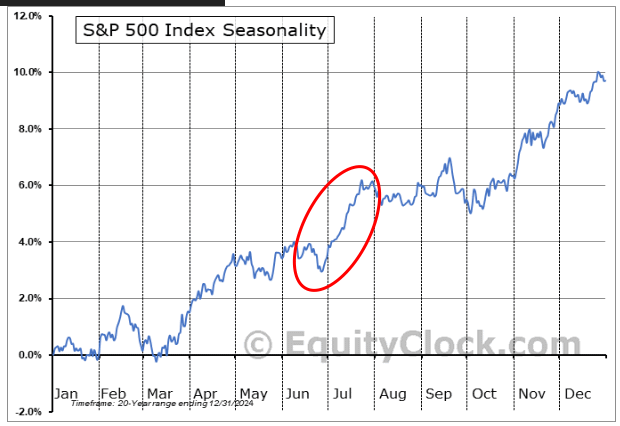

And as predicted, the late-June/early-July calendar tailwinds are working:

Furthermore, our backtests show that after major breadth thrusts (the recent one occurred in April) the 3-month, 6-month, and 12-month subsequent performance are strong with a high success rate. Needless to say, the ongoing rebound is on track. In fact, the performance since April is on the high end of expected outcomes. We are on track for 24% gains by next year, which gives an SPX target of $6800 (coincidentally, this is an important Fibonacci extension level).

Last week we outlined our three pillar thesis for the market rebound to continue. In short, we want resilient economic data, solid corporate earnings, and an end to the trade war. All of these things are playing out nicely, which means we likely won’t see a big drop in stock prices anytime soon.

New tariff tensions…

The rest of this article is for premium members. Today’s post covers:

Bad news on the trade front

Powell’s replacement - reaction is premature

Nike’s earnings and what it means for consumers

Chip King Nvidia is facing threats

New catalysts on the way

Keep reading with a 7-day free trial

Subscribe to MKTCONTEXT to keep reading this post and get 7 days of free access to the full post archives.