🍔The Melt-Up Continues

Are we at the top yet?

Flows and positioning

This week we learned several important things about where the relentless equity-buying flow is emanating from. During a bull market rally, it’s important to understand who in the marketplace is buying and what their motivations are for doing so. This tells us how sustainable the rally is.

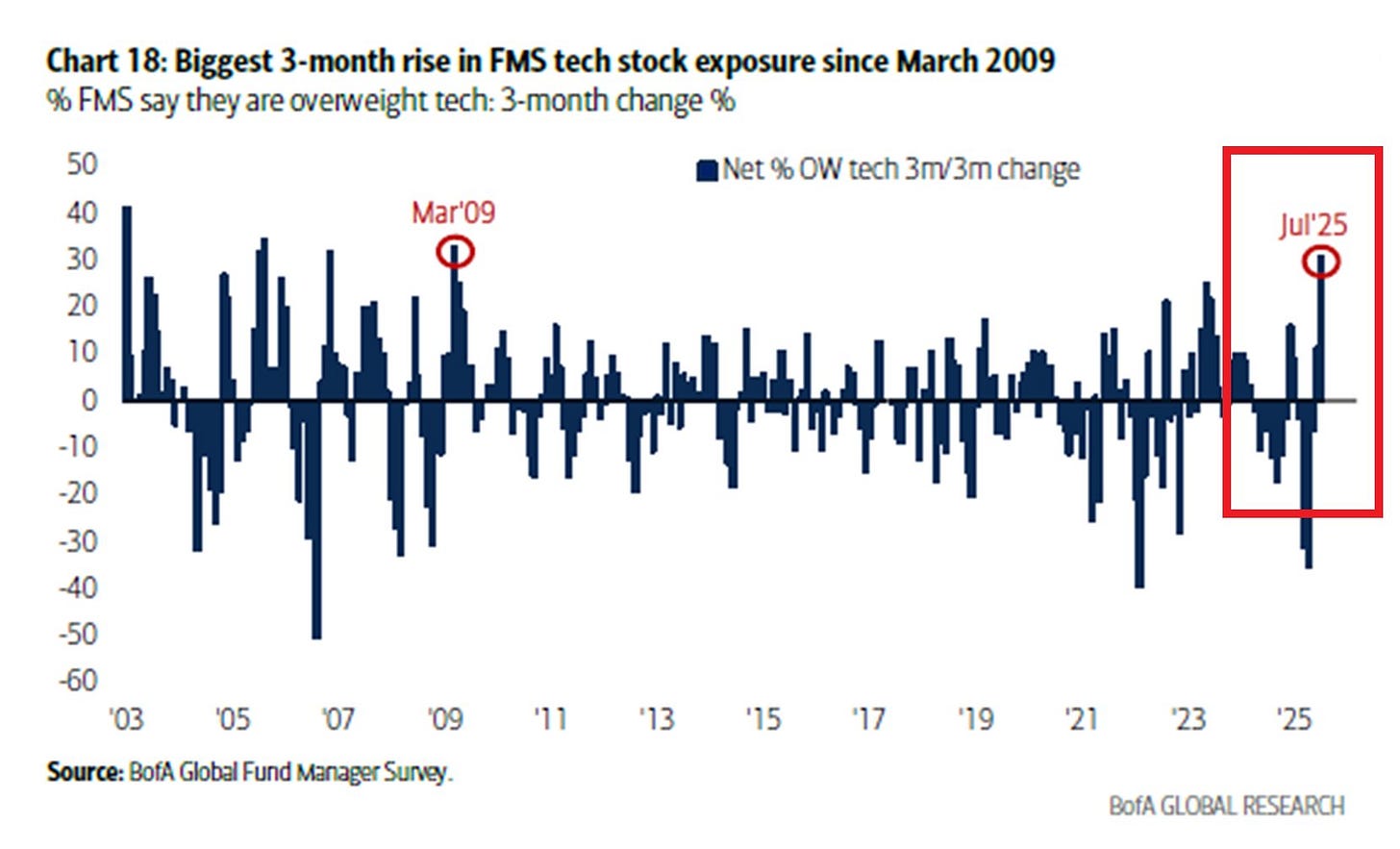

The first set of buyers is institutional fund managers chasing tech exposure. After the spectacular collapse in Mag 7 and tech stocks in Feb/March, many managers were left under-exposed to tech. Now tech is one of the better performers since April and managers have had to chase it back up in one of the fastest positioning reversals in 16 years:

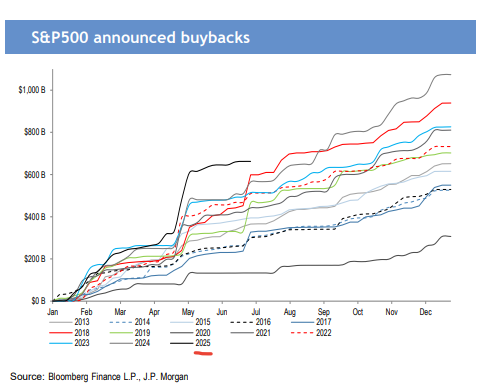

The second is oddly unintuitive, which are corporate buybacks. Due to uncertainty created by tariffs, CEOs were hesitant to reinvest in their businesses. They instead used the excess capital to buyback their own shares on the open market, boosting the value for remaining shareholders. Buyback flows this year have been bigger than any previous year, and has been a huge source of demand in the marketplace:

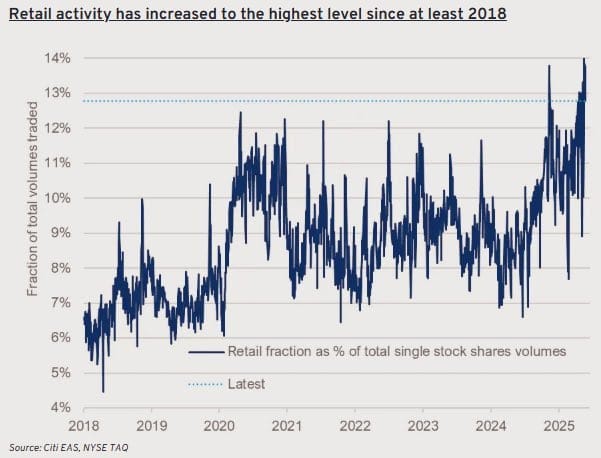

Thirdly, retail investors have joined the party. Retail investors love a good bull market and they have been aggressively buying this rally. These have been the ideal conditions for retail: stocks going up in a straight line without pullbacks or volatility. Even more impressive is that retail activity is higher than the go-go years of 2020/21:

Our takeaway from all of this is that positioning is above average, but still far from extreme levels. There is still a large cohort of institutional, hedge funds, and systematic funds that are yet to flip bullish. Many investors cling onto the belief that a stagflationary recession is coming, even though the price action is not supporting this view. As these holdouts capitulate, it will provide a final melt-up push in the market.

New inflation worries

10-year interest rates spiked to a high of 4.5%; are we in trouble now?

The rest of this article is for premium members. Today’s post covers:

Is inflation a real threat?

Interest rates on the rise

When is it time to switch to small caps?

Trump to fire Powell

Our current portfolio and SPX target price

Keep reading with a 7-day free trial

Subscribe to MKTCONTEXT to keep reading this post and get 7 days of free access to the full post archives.