🍔From One Bubble to the Next

Plus: Our target price for Bitcoin

The risk-on tone continued this week, with the S&P500 and Nasdaq at fresh highs thanks to growing optimism that more trade deals would be reached. Underneath the surface, there is a rotation underway that is affecting tech stocks versus the rest of the market. Is this the time to sell? We discuss all of that in the post below.

From one bubble to the next

This week the crypto bubble receded from fever pitch. Bitcoin and Ethereum pulled back modestly, as did many of the crypto-adjacent stocks (HOOD, COIN, CRCL, BMNR). It appears the much anticipated “Crypto Week”, which culminated in the passing of three new regulations into law, was a sell-the-news event. When investors bid up stocks leading into a known event, they sell once the event passes.

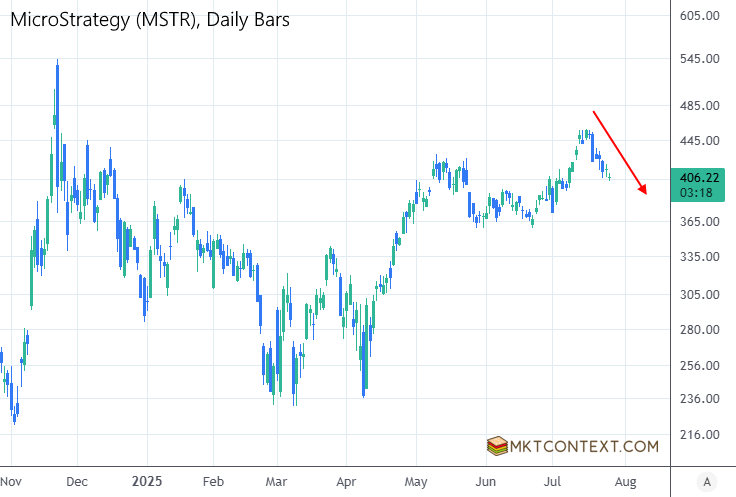

When frothy stocks pull back, there is often an air pocket on the downside. Here is MicroStrategy (MSTR) which runs a 2x-levered strategy issuing billions in convertible debt to buy BTC:

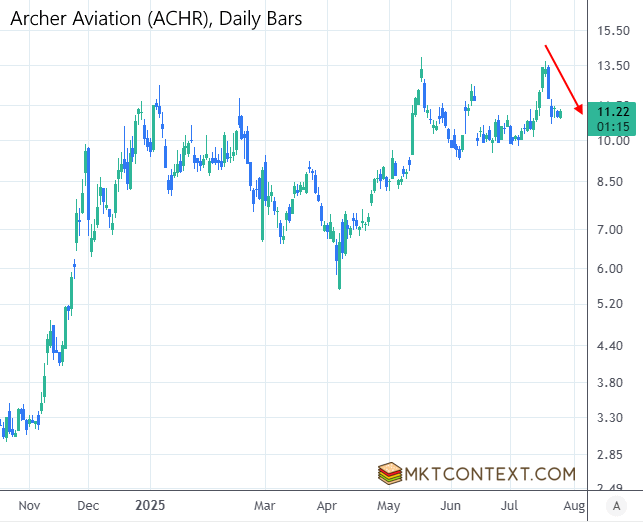

Similarly, there were pullbacks in other over-extended thematic sectors like eVTOL stocks (ACHR, JOBY, UMAC), space stocks (RKLB, RDW, ASTS, BKSY), and batteries (QS).

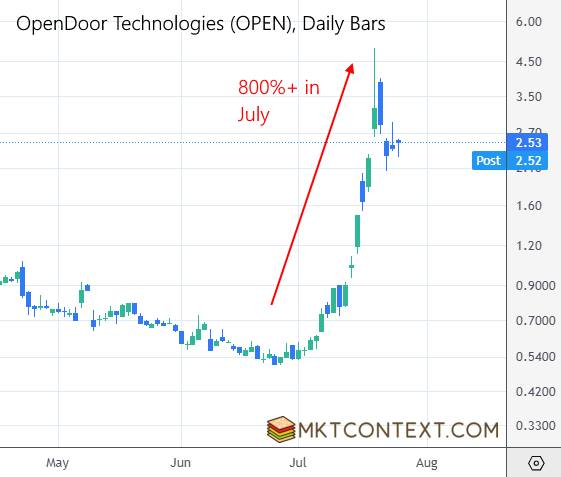

But no sooner had these stocks deflated, a new bubble emerges. That is of high-short-float meme stocks, pushed by Reddit’s WallStreetBets in effectively a mass short squeeze. Names like OPEN, KSS, DNUT, RKT, GPRO, WEN saw mindboggling rallies (some up 800%+) despite having almost no viable business model nor earnings.

Here’s what the bubble rotation means for the rest of the stock market…

The rest of this article is for premium members. Today’s post covers:

Trade deals galore

What the credit cycle tells us about economic health

Market seasonality is changing

Sector rotation continues, Nasdaq underperforms

Could Bitcoin continue its run?

Keep reading with a 7-day free trial

Subscribe to MKTCONTEXT to keep reading this post and get 7 days of free access to the full post archives.