🍔Extreme Fear in Stocks

Why we are cautiously optimistic on this market

Another wild week in stock markets. On Monday, the S&P500 gapped up and rallied hard, on news that the longest government shutdown would be ending. But that was not enough to prevent fierce selling on Wednesday and Thursday.

On Friday, the market gapped under the all-important 50-day moving average, before rallying back the entire day. This kind of whipsaw price action is signaling the next turn for stocks.

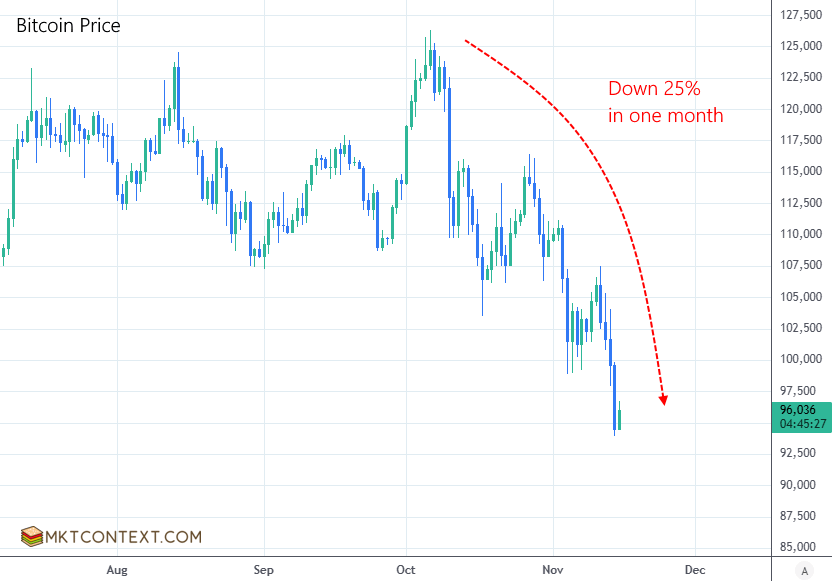

We’ve seen a lot of carnage lately in the tech market, first in unprofitable tech and now in mega caps. We’ve also seen a massive pullback in crypto since October. Bitcoin price is down -25% from highs:

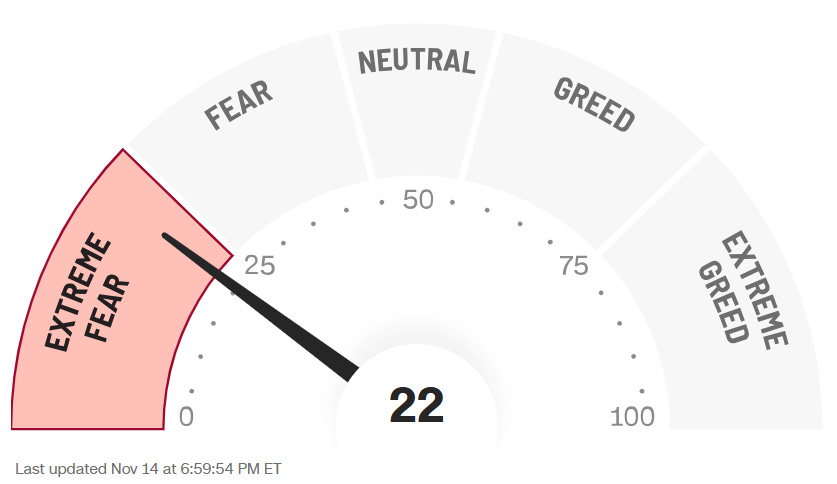

Sentiment is very negative out there. In fact, the Fear and Greed Index is registering extreme fear!

Investors are worried about the durability of this rally. Negative sentiment is being driven by three things: 1) questioning AI spending, 2) questioning the Fed’s rate cuts in December, and 3) questioning the resilience of the economy. We discuss this wall of worry below.

Have stocks seen the highs for the year? Or can the AI bubble continue? In this report we break down the fundamental and technical picture, and predict what’s coming next…

The rest of this article is for premium members. Today’s post covers:

Government shutdown ended, what’s next?

Natural gas breakout and long thesis

Sector rotation from junk tech into defensives

Technical analysis and portfolio positioning

Keep reading with a 7-day free trial

Subscribe to MKTCONTEXT to keep reading this post and get 7 days of free access to the full post archives.