🍔Deluge of Delayed Data

More interest rate cuts are likely coming

After a 5-day selloff in AI stocks, the US government breathed life back into the sector this week. CoreWeave, a GPU-cloud data center company, signed on to the Genesis Mission to provide its AI cloud. Recall we first reported on the Genesis Mission two weeks ago, calling it the modern day Manhattan Project.

Public sector spending via Genesis Mission allays investor concerns around the durability of AI spending. It also provides fiscal support to the broader economy and the stock market. “Run it hot” is the name of the game heading into a midterm election year.

At the same time, Trump announced by Executive Order a new space exploration policy. The Order calls for US’ return to the moon by 2028 and a lunar outpost by 2030. They also want nuclear reactors on the moon and in orbit; truly sci-fi level stuff.

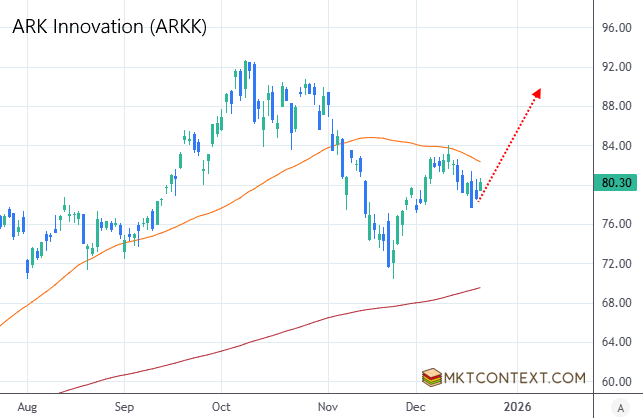

Junky tech stocks like Intuitive Machines (LUNR) and Rocket Lab (RKLB) spiked up as much as 38% on the news. This very well could be the recovery of junk stocks, as proxied by ARKK:

The stock market has been stuck in a sideways pattern for over 3 months, as shown in the chart below. Meanwhile, commodities are soaring and Bitcoin keeps melting down. We’ve never seen such a bifurcated market.

The market is no longer going up in a straight line, lifting all stocks with it. You need to pick the right sectors and stocks. In order to do so, you must understand the market context. This includes the economy, policy, investor positioning, and sector trends. Today’s post dives deep into all of those aspects…

The rest of this article is for premium members. Today’s post covers:

Deluge of delayed data

Inflation cools

Setback in the economy

More problems at Oracle

Earnings revisions accelerating

Equity rotation under way

Positioning and our portfolio

Keep reading with a 7-day free trial

Subscribe to MKTCONTEXT to keep reading this post and get 7 days of free access to the full post archives.