🍔AI Capex Overheated

Shock absorbers removed from the market. Know when to sit on hands and avoid overtrading.

Welcome back to MktContext where we study the US economy and time the stock market.

We got the long awaited Supreme Court ruling on tariffs this week. Trump announced a new 10% global tariff… and markets responded with a yawn. It is apparent that tariff terror has largely passed, with little to no sustained impact on inflation.

Instead, we focus on the things that actually matter right now: The AI capex cycle and the possibility for a bullish “truce” in the arms race. We discuss more in depth below.

While we see the potential for a strong rally in the coming months, there is still reason to be concerned. The shock absorbers have been removed from the market, making it vulnerable to a February selloff. Will we see a repeat of the 2025 bear?

Today’s topics: AI capex, Mag 7 implications, capex cuts, tax refunds, positioning, technical analysis, our portfolio.

Tariff ruling

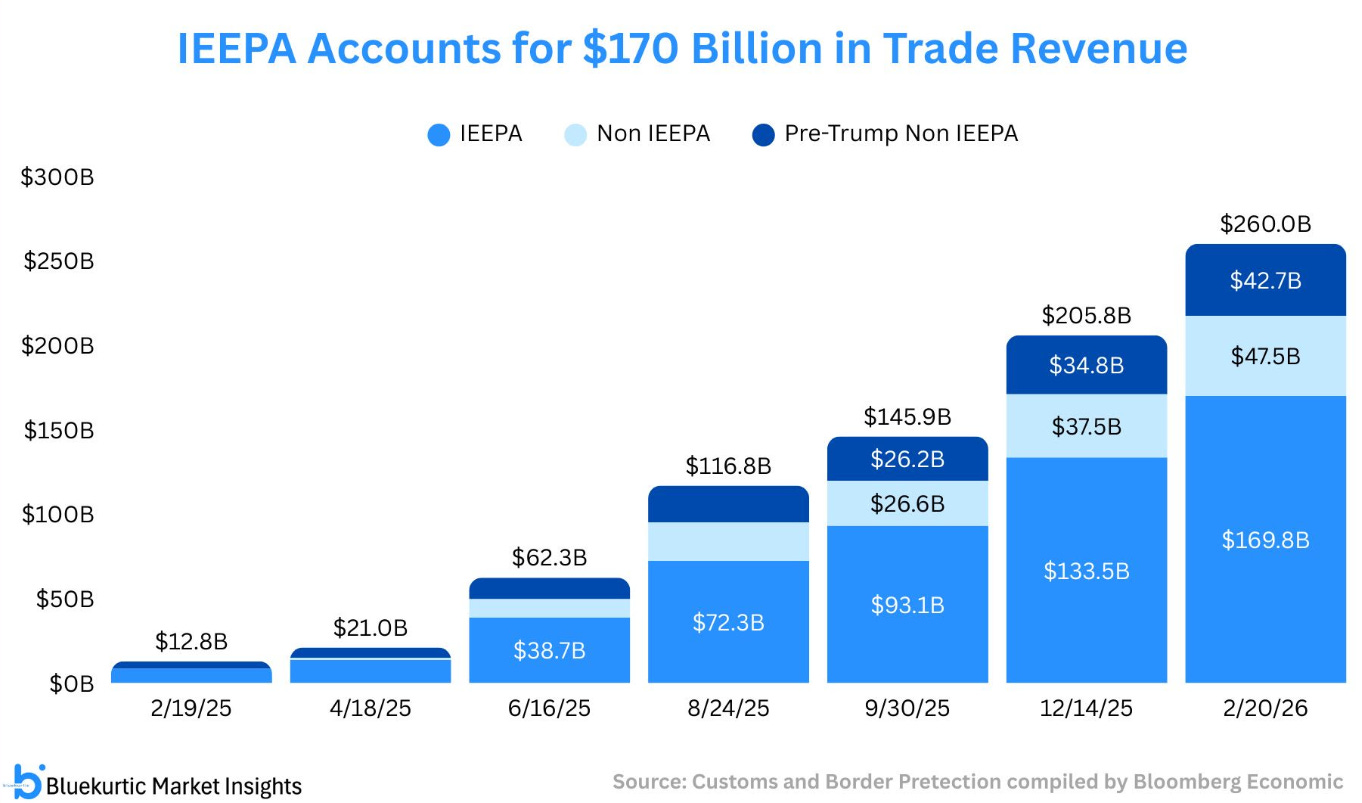

The US Supreme Court struck down Trump’s tariffs, as widely expected would happen. However, no judgment was given on whether refunds are due. Trump responded by saying he would reinstate the tariffs under a different legal authority. He subsequently announced a new 10% global tariff lasting 150 days.

Over 1500 companies have already filed for refunds totaling $170B. However, we think there is little to no chance these refunds will be issued.

In contrast to the cataclysmic reaction to the April tariffs, market ignored the new 10% tariffs. Trump himself has repeatedly shown these to be empty threats. Markets rallied due to the removal of this uncertainty overhang, particularly tech and consumer companies which were the primary beneficiaries of cheaper imports.

Inflation markets were also muted. At this point, tariffs have not demonstrated a flow-through to higher inflation, and only a small impact on employment. In our view, peak tariff terror has passed. With this overhang out of the way, the rally setup looks much cleaner.

AI capex overheated

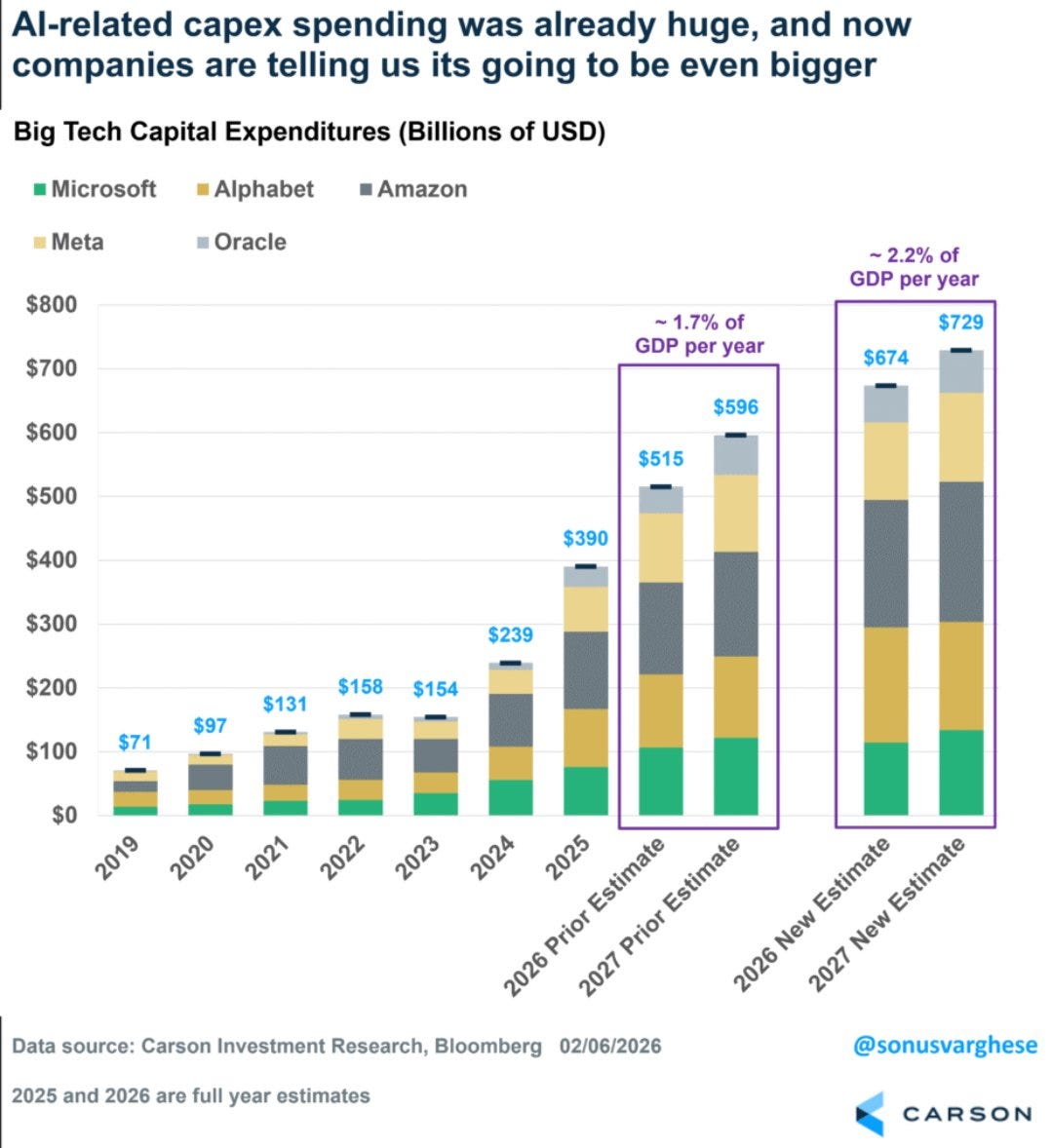

For the mega cap tech stocks, the market cycles between “more capex is good” and “too much capex is bad”. The current narrative is the latter, evidenced by negative stock price reactions to recent announcements by hyperscalers. Capex budgets have been aggressively increased for the coming year, and are now set to make up 2.2% of GDP:

Google co-founder Larry Page was quoted saying “I’m willing to go bankrupt rather than lose this race.” In case it wasn’t already clear, this is not AI hype; it’s capital war.

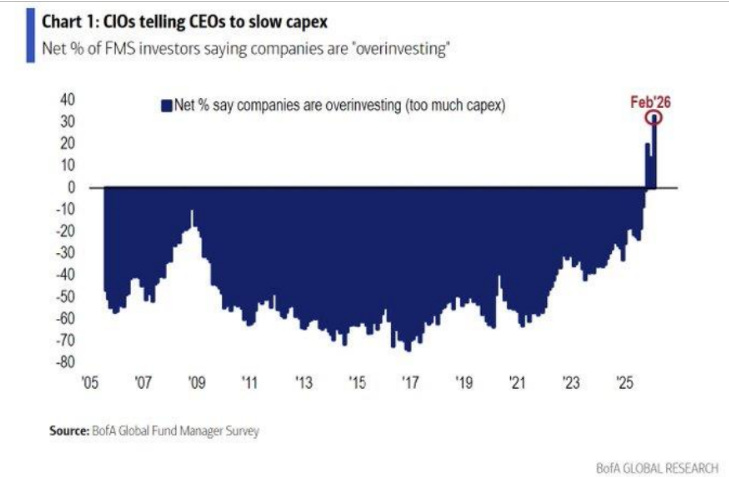

Capex spending is only good when it can generate a profit. Investors push back on spending when ROI is questionable, and not enough to justify growth ambitions. This is what led to the selloff in Oracle (ORCL) which is down -60% from highs. As shown in the chart below, investors want companies to slow down capex:

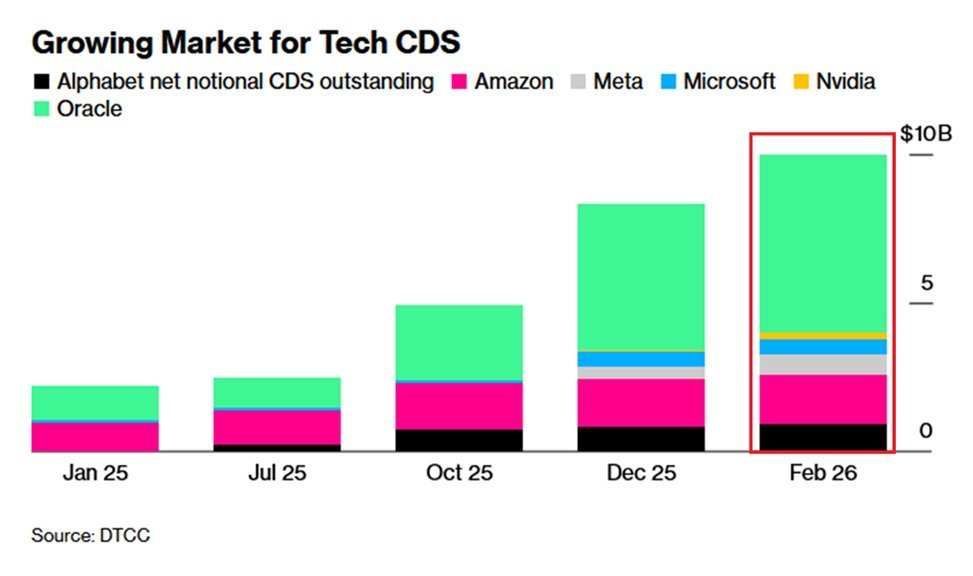

We also see this response in CDS markets, which are insurance policies against bond defaults. Big tech companies issued $100B of bonds so far in 2026, and investors demanded record protection against it. That signals investors’ appetite to fund the capex train. At some point, the market maxes out of capacity to absorb any further debt, creating refinancing troubles down the road.

As technology progresses and Chinese competition remains ever-present, the capex becomes ever-harder to justify. Moore’s law says that things should be getting cheaper, not more expensive. It is likely that big tech companies will soon start walking back their capex plans in light of investor reactions.

To see our trades and portfolio, consider upgrading to paid subscriber status.

Implication for Mag 7

Capex by hyperscalers is set to reach 92% of cash flow, effectively soaking up all excess cash generated by these lucrative businesses. As a result, stock performance is tied to their ability to monetize investments…

The rest of this article is for premium members. Upgrade now to continue reading:

Capex implications for Mag 7

Capex cuts are coming

Big tax refunds

Positioning cleansed — this is bullish

Mixed technical picture

Our portfolio

Claim your free trial by clicking the button below!

Keep reading with a 7-day free trial

Subscribe to MKTCONTEXT to keep reading this post and get 7 days of free access to the full post archives.