🍔A Rotation is Under Way

We're sounding the alarm!!

Happy Thanksgiving to all our wonderful readers and subscribers!

We want to express our heartfelt thanks to each and every one of you for being part of our community. Your support, engagement, and loyalty mean the world to us, and we're honored to have the opportunity to share our ideas with you. We look forward to providing more valuable content in the days and weeks ahead.

From our family to yours, warmest wishes for a joyous, relaxing, and refreshing holiday!

-MC

In today’s post, we dive deep on the market rotation that is currently under way. This affects many of the mega cap “Mag 7” tech stocks, and by extension, the major indices S&P 500 and Nasdaq.

In the premium section, we are also sounding the alarm on our famous put/call skew indicator. We also made major changes to the portfolio that you don’t want to miss. Seriously.

Rotation is under way

The broader indices took a breather on this shortened week after the torrid rally of the prior week. SPX and small caps (IWM) sit right at their highs, threatening to break out, as the bull market continues in full force. However, we are starting to witness some interesting divergences that give us pause.

The equal-weighted SPX, relative to cap-weighted SPX, bottomed in July and has now broken out of its late 2024 downtrend. This is consistent with the piece we wrote last week about the Mega Cap rotation. It means the large tech companies that have dominated for most of ‘23 and ‘24 are starting to give way to small companies. The timing is appropriate given falling interest rates, a fresh growth impulse, and a new political regime.

Same goes for equal-weighted QQQ. This is particularly notable given the heavy concentration of this index (51% of the index is stacked in the top 10 names) and the over-reliance on Mag 7. Again, we wrote a must-read thesis last week on why regulatory headwinds and earnings growth will cause Mag 7 to sour. We specifically listed Microsoft, Apple, Google, Meta, Amazon, along with the AI-related names like Nvidia starting to fade. This is going to be a major handicap for cap-weighted QQQ to continue is outperformance.

Next is equal-weighted QQQ vs equal-weighted SPX — comparing the tech sector against the rest of the market without the dominance of Mag 7. While tech has held flat in relative performance, it has certainly not outperformed. Its weakness has been strictly due to semis (e.g. Nvidia, AMD) and semi equipment (e.g. ASML), a thesis we also outlined last week. With the air starting to leak out of the AI bubble, this industry is now becoming a “show me” story.

On the other hand, IWM small caps have been making new highs all year long and is now starting to break out and outperform SPX. This makes fundamental sense because cyclical growth is returning to the economy and we are no longer reliant on the scarce secular growth of Mag 7 to drive us forward. The bull market is broadening to other sectors; a sign of great strength. We’ve been highlighting our IWM thesis as early as September in a post entitled “This Sector is About to Explode”. Well, it’s exploding now and about to break out further.

Earnings growth is the foundation of any sustainable equity rally. And Russell 2000 small cap earnings are exploding upwards in the coming quarters, to the tune of 28 to 57% year-over-year growth. Investors thought double-digit earnings growth was impossible; and yet last quarter it put up 20% growth. It’s just getting started.

BONUS: Even value stocks look like they’re staging a comeback here. That’s incredible, seeing as this Buffet-favorite has been sucking wind for nearly two whole decades. Sure there’s been many fake-outs, but with the change in fundamentals we’ve been outlining for the past month, this time could be different.

All of this has profound impact on portfolios. In the premium section below we share major portfolio changes to capitalize on this long-awaited rotation.

Flows and positioning

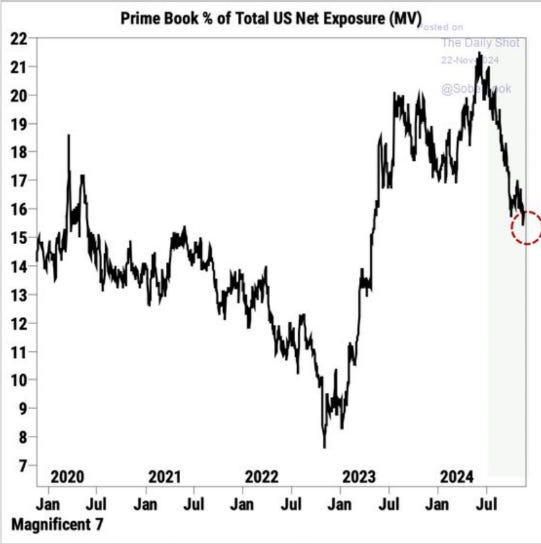

Further to the above discussion, here’s a chart from @SoberLook on Twitter/X that shows hedge fund exposure to Mag 7. Clearly, the big boys have been rushing out of Mag 7 stocks since July, which likely caused the relative underperformance since then. This is a moving train that we do not want to step in front of.

We're helping traders and investors make money in the market. Help spread the word!

Macro update

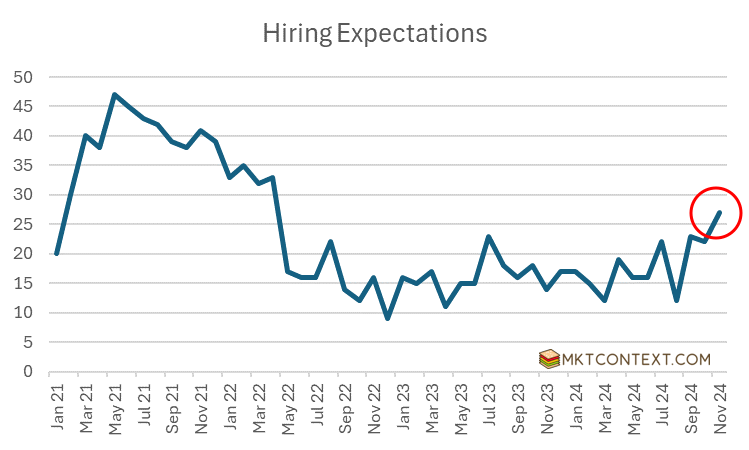

It was a whirlwind week for econ data, but one standout caught our attention — the Richmond Fed's Services Index, which suggested US employers' hiring intentions are at a 30-month high. Much of this is pent-up demand from election uncertainty. Overall, the data continues to support our thesis of a resilient US economy.

The elephant in the room is the uncertainty around Trump’s fiscal agenda. His latest cabinet picks hint at more tariffs and mass deportations, leaving investors wondering how this will affect economic growth. Timing is crucial here; if these negative supply shocks come before the planned fiscal stimulus (tax cuts, deregulation, oil drilling) it could slow GDP growth or fuel inflation.

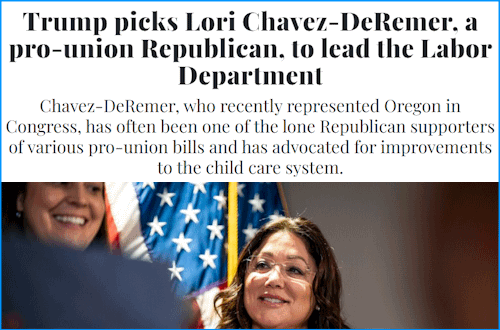

There’s also widespread misconception about the administration’s views. For instance, people think Trump is anti-labor laws and unions. After all, he reduced overtime pay in his first term and he praised Elon Musk for firing tons of people. But in this election, he appealed to unions for their support. His recent Labor Department nomination is pro-union. This will have implications for labor cost inflation across the US. Anyway, it appears he has tapped into the populist mindset, so to understand the agenda, one only needs to follow the populace.

Let's be clear: This isn't a politics blog, and we're not here to debate right vs wrong. I’m neither Dem nor Rep; I’m an investor. We are simply observing that the market is misunderstanding what’s in store for the next 4 years, and that uncertainty is liable to cause gyrations in the market. As investors, we must remain agnostic about the world (even politics!) and look only at the facts.

Fed is confused…

The rest of this article is for paid subscribers. Upgrade now to continue reading:

The Fed is confused

Rate fever broke

Sounding the alarm!!

Breadth divergences

MAJOR PORTFOLIO CHANGES

Bulls don’t die of old age

Claim your one week free trial below!

Keep reading with a 7-day free trial

Subscribe to MKTCONTEXT to keep reading this post and get 7 days of free access to the full post archives.